With the aid of an effective provisional Approve Page, anyone can see a loan toward a simple-track foundation

It entails very long to obtain the best home having you, plus it means numerous trips about urban area to access various societies and you will rentals. If you find yourself looking to buy a house with home financing, you’re going to have to go through yet another round from conferences towards financial, that encompass numerous levels of documentation and you may documents. Henceforth, Family First Monetary institution features electronic choice home financing classification so you can make clear the procedure of obtaining a good mortgage.

Domestic First Monetary institution habits Express Financing to make the loan processes brief and you can simple. It’s easy to get a mortgage online in the at any time and you can away from one place.

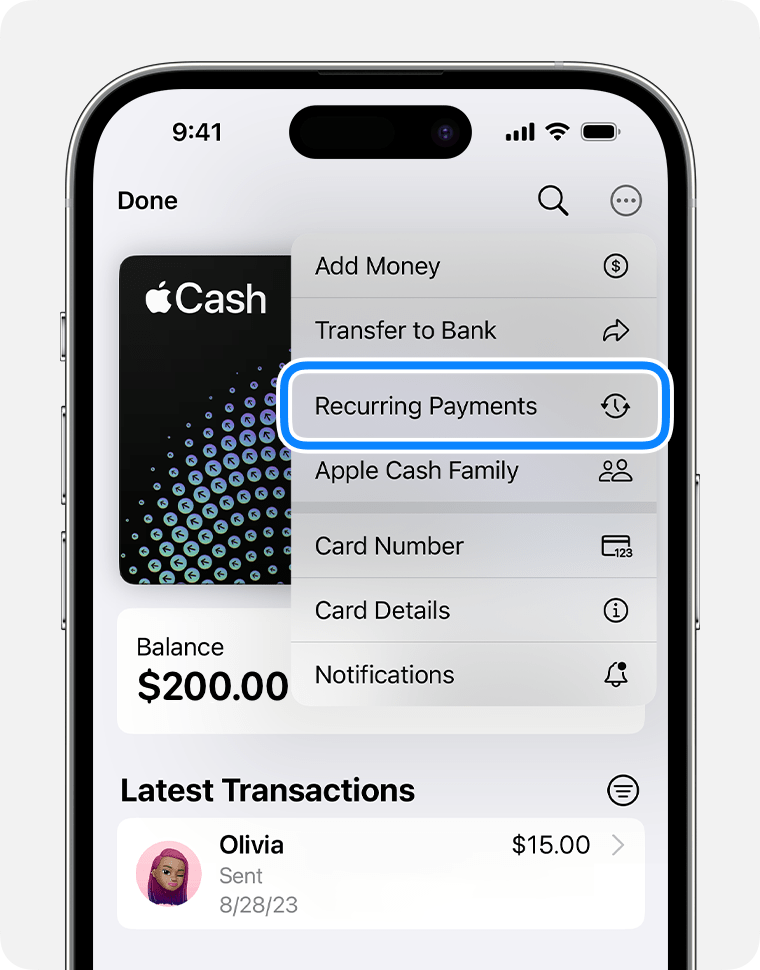

Once you fill out your application on the web, might found prompt acceptance. HomeFirst enables you to receive that loan sanction within just 5 basic steps. The service provides a short Approve Letter, about what you can see financing.

Step one: Verify your bank account | Step 2: Talk about your income information | Step three: Identify your property facts | Step four: Render the contact details | Step 5: Get a loan bring

Top features of HomeFirst Financial

- It may be recognized in just a few clicks.

- Today regarding mortgage acceptance, no records are needed.

- Top corporates can take advantage of another type of processing contract.

- The transaction was paperless, and the entire household application for the loan procedure is done on line.

Qualification for Mortgage

Credit history/Credit file: Normally, loan providers always lend to help you individuals with credit scores away from 750 otherwise over. Instance mortgage individuals features a far greater likelihood of bringing mortgage loans with reduced interest rates.

Ages of new Applicant: Fundamentally, the lowest ages to try to get a mortgage is actually 18 decades, as well as the restriction many years at the time of mortgage maturity try 70 age. The new repay big date is normally as much as three decades Alaska bad credit personal loans, with many different loan providers capping age advancing years while the restrict years restriction.

Income and a position: A leading income suggests an increased capability to pay off that loan, implying a lower risk to the financial. Because of their large-money predictability, salaried personnel normally have a much better threat of obtaining house loans during the lower interest rates.

Repayment Capabilities: Finance companies and you may HFCs tend to accept house loans to help you people whose whole EMI connection, for instance the proposed financial, will not exceed fifty% of their total income. As opting for a lengthier financing period decreases the domestic loan EMI, persons having lower mortgage eligibility can better their state of the going for a lengthier period.

Property: When choosing family mortgage qualification, loan providers think about the property’s shape, strengthening features, and you can ount that may be considering on the property. The maximum amount a loan provider could offer for the a property loan usually do not go beyond ninety per cent of property’s worthy of, predicated on RBI direction.

Data files Needed

To locate a mortgage, an applicant must provide enough data files installing its KYC, the antecedents of the property they seek to get, its income history, and stuff like that, dependent on which customer classification it get into (salaried/professional/businessman/NRI).

The fresh papers needed is different from one financial to a higher. Listed here are probably the most normal records you’ll need for a home loan inside the Asia.

How exactly to Use?

Before you start finding your dream home, you’ll have a concept of how much cash off property mortgage you’d be eligible for predicated on your income. It will assist you in and then make an economic wisdom regarding the family you’d like to and obtain. You can make use of the borrowed funds eligibility calculator to decide how much cash money you are qualified for. Once the assets could have been done, you may check out the HomeFirst site and you may submit the fresh new query means to find a trip right back from a single of one’s Counsellors. You can read this information for more information on financing terms and conditions, or this article to learn about the fresh records needed for financing programs.

Towards the more than advice at your fingertips, you can demonstrably address the issue out of simply how much family financing one could acquire considering his or her earnings or take a huge action towards getting the dream house.