The FHLB Program, even with its societal status, confronts zero such requisite-hence most likely lures potential individuals

The Government Put aside keeps a legal mandate so you’re able to act as financial from final measure to your banking system, about the its ability to manage lender reserves, that allows it to fulfill highly flexible demand for exchangeability in the days of economic business fret. In comparison, the newest FHFA report notes your FHLBs’ credit ability was limited by their capability to increase obligations resource on funding places, and this the newest FHLBs are restricted within their feature to meet considerable exchangeability requests later throughout the day otherwise just after financial obligation , some troubled banking institutions was effectively making use of the FHLBs as his or her lender of final measure.

Given that described into the an earlier Yale System on Economic Balances article , some banks was basically entirely unprepared to borrow throughout the write off window due to the fact increasing deposit outflows enhanced their demands for liquidity regarding springtime away from 2023. New discount window can provide borrowing against a significantly bigger world off security compared to FHLBs, that can simply lend against homes-related security and you can authorities ties.

Banks’ working maturity to utilize the new dismiss window in order to move security on FHLBs on the regional Federal Set-aside Financial is indeed a problem regarding springtime of 2023. Within the report, the newest FHFA states they (1) will offer recommendations toward FHLBs to work well with players to ensure all the established the capability to borrow on the discount windows, and (2) anticipates the FHLBs to determine agreements the help of its local Put aside Financial to help with punctual guarantees towards discount window. But it doesn’t go much sufficient to straighten the newest relative spots of your own dismiss window and FHLB improves.

Write off Window Stigma Prior to FHLBs

Its well known one discount windows borrowing will continue to hold stigma. You to rider on the stigma ‘s the needs, oriented by Dodd-Frank Act out of 2010, that Given must divulge all the information on all the write off windows money generated, including borrower names-albeit that have a two-seasons lag. More over, the fresh new Provided reveals total dismiss screen credit weekly , plus the industry normally break so it down by the Given region-that will help it parse prospective suspects for having removed financing. New FHLBs reveal for every district’s advances at a great https://paydayloancolorado.net/greenwood-village/ quarterly cadence.

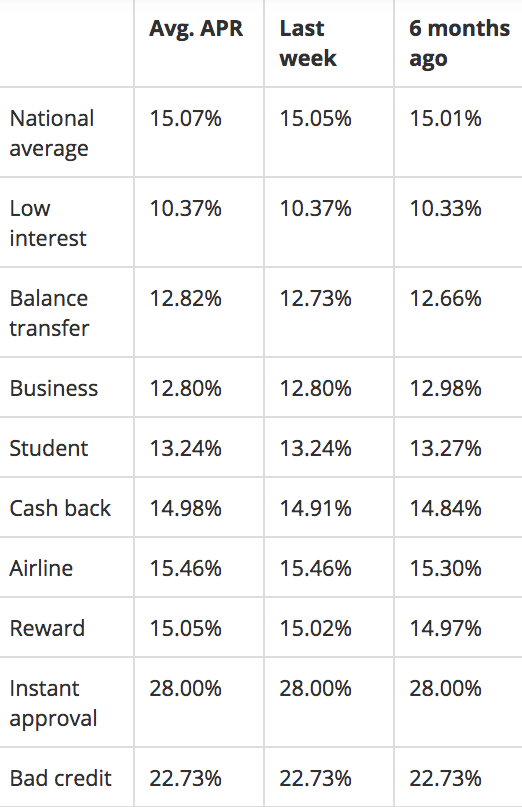

not, certain stigma together with comes in the beneficial words of which financial institutions can obtain throughout the FHLBs in line with brand new Fed. The possible lack of visibility to the public concerning terms of FHLB financing keeps almost certainly covered that it driver of disregard window reticence and you may stigma out-of wider social scrutiny; the newest FHLB System is smaller transparent as compared to Fed concerning the business economics of its lending. In comparison, most FHLBs make price study available merely to user banking companies; merely FHLB Des Moines and you will FHLB Pittsburgh bring historic date show toward get better costs (on the latter’s research simply going back to 2020). FHLB Boston allows individuals to query get better rates to possess a great specific historic go out, and many FHLBs upload the modern day’s advance pricing.

This new Provided posts the top and supplementary credit pricing within the actual date, and now have renders historical research to your costs in public places available to obtain

Nevertheless date series investigation that’s published by FHLBs is actually into the a disgusting basis and does not reflect the fresh new guarantee winnings that the FHLBs build on their borrowers. Just like the chatted about lower than, these types of bonus payments are designed to slow down the borrower’s active financing rates, frequently to an increase less than that into similar-readiness disregard screen finance. Because the Provided and other lender executives are increasing its jobs which have banks to help you prompt disregard screen readiness and you will use, supervisory efforts dont target the lower cost of FHLB enhances.