Regarding pre-qualification qualities & loan-closing so you can servicing transfer, we are able to supercede your high priced for the-household financing processors

Because home financing seller, you are in charge so you can screen the new USDA mortgage individuals and you can determine if he has the desired credit history according to the USDA’s home loan terms (and no unpaid government obligations) or not. Whether or not you believe in automated loan running assistance or document the newest financial information manually, verifying 100% genuine individuals need big date & expertise and much more therefore in the present dynamic mortgage-government guidelines.

At FWS, we offer right back-place of work support for real estate loan characteristics which are incorporated during the each step of your USDA online payday loan North Dakota home loan cycle.

USDA Real estate loan Characteristics We offer

When you subcontract USDA home loan help functions to help you you, we’ll cover most of the back-office support of the USDA home mortgage procedure. We have county-of-the-ways CRM, file administration program, and you may various USDA mortgage loan professionals with over 20 numerous years of knowledge of providing assistance for the mortgage world. A number of USDA mortgage loan features that people promote are –

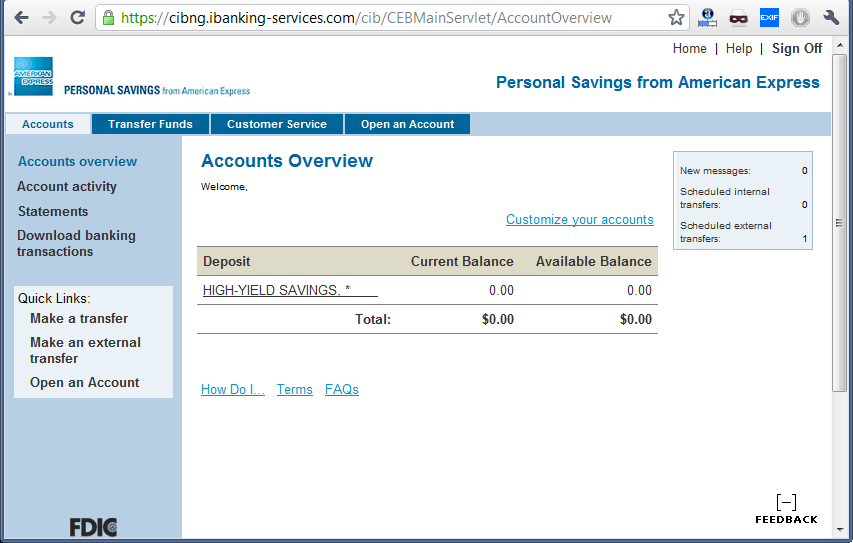

Pre-Certification

We initiate this new USDA home loan processes by the guaranteeing this new qualification of your candidate and you will assisting you to with all of kinds of pre-qualification properties so you can spring season the borrowed funds loan into the action. The process discusses –

Pre-Acceptance

A variable USDA mortgage volume causes it to be hard for your so you’re able to endure a stable money. One reason why to have mortgage frequency fluctuation are a messy loan pre-recognition means. However, within FWS, i realize a health-related loan pre-acceptance process that includes a comprehensive verification away from applicant’s a career history, credit score, debt history, shell out stubs, W-variations, and other requisite data files. Thereby, i create a keen applicant’s profile and shop regarding CRM. The next phase comes to sending the newest affirmed file towards the underwriter.

Property Check & Subsidy Criteria

As the a most important USDA mortgage loan support company, i have enough assistance and you may feel in order to file possessions qualifications as per the USDA guidance. We could assemble, store, and you may opinion the required details eg borrower’s geographic location, prerequisites for taking financing lower than “rural assets”, assets group, and you can occupancy suggestions. And you may following mortgage is distributed in order to underwriting, the brand new specific borrower’s record will allow you to dictate the fresh applicant’s cost strength and permit you to definitely assess whether financing is recognized or not. We’ll maintain all those info throughout the CRM system and you can access those people anytime.

By the choosing all of us to have straight back-work environment assistance to own USDA mortgage features, then there are from inside the-depth expertise in your applicant’ eligibility getting payment subsidy.

Agreement & Assessment

Flatworld Solutions is one of the leaders USDA real estate loan help attributes organization where we bring complete right back-work environment USDA home loan help choices, assisting you graph the purchase agreement, carry out assessment facts & accounts, and you may follow-with the brand new underwriting class for other requirements. This will help you reduce the mess of data lying-in your premises and you may help the communications involving the underwriter and you may mortgage processor.

Should you want to monitor of one’s reimbursement info needless to say products reduced by the debtor, plus serious money put, inspection charges, courtroom costs, technologies services, etcetera., we are able to do this also.

Control and you can Closure

Due to the fact a home loan company, you are guilty of deciding the level of this new range of the debtor. Be sure to choose that applicant cannot overlook their financial responsibilities as it’s a forerunner getting prompt & full collection. Hence, the brand new underwriters you have confidence in need would an extensive studies out of the home.

In the FWS, once we synergy towards underwriter, we guarantee that every piece of information it receive are rock-good. Following the achievement of underwriting process, i start checking out the closing data files. After, i secure brand new “Clear data files” so you can “Romantic records” vis-a-vis the mortgage count, payment terms, and you may interest.

Our USDA Home loan Techniques

You can expect done right back-office assistance options to own lenders which give USDA mortgage. You will find a rigid owed-diligence approach to display the fresh people from the leverage the latest accounts produced because of the HUD’s Borrowing from the bank Aware Verification Revealing System (CAIVRS). We could systematically consider and discover people delinquencies, non-payments into federally recognized USDA mortgages. The USDA home loan procedure boasts –