Purchasing home financing need not be overwhelming particularly when you understand the fundamentals

Real estate Concepts

All home loan possess two parts: prominent and notice. The main ‘s the matter your acquire, additionally the desire is exactly what you have to pay to use the cash. More home loans leave you options on the best way to framework your appeal costs to fulfill your specific means.

When shopping for a home loan, there are two main biggest kind of funds to favor from: a fixed-speed financial or a varying-rate home loan (ARM).

That have a fixed speed financial, your dominant and you will appeal repayments stay the same into life of your own mortgage-the right choice if you are planning in which to stay your residence for quite some time. While the rate of interest will not transform, you will be shielded from ascending cost towards the life of the loan.

- Dominating and you may attract costs stand a similar towards lifetime of the borrowed funds

- Consistent monthly installments allows you to funds better

- Choose from different year words, such as for example 29 seasons otherwise 15 12 months

Having a variable rates mortgage (ARM), also known as a varying speed home loan, the Interest, monthly principal, and you will appeal money are a comparable getting an initial several months, following to improve a year predicated on a speeds list.

- Typically have a lesser first interest rate than a fixed-rates mortgage

- Rate of interest limits set a threshold regarding how highest their attention rates may go

- Select from 6-week, 1-, 2-, 3-, 5-, and you may eight-year terminology

If you’re considering an arm, it is a good idea to ask your lending company exactly what your own payment per month was when the interest levels increase step 1, step 3 otherwise 5 payment situations later, for finding a feeling based on how even more your may be needed to spend later.

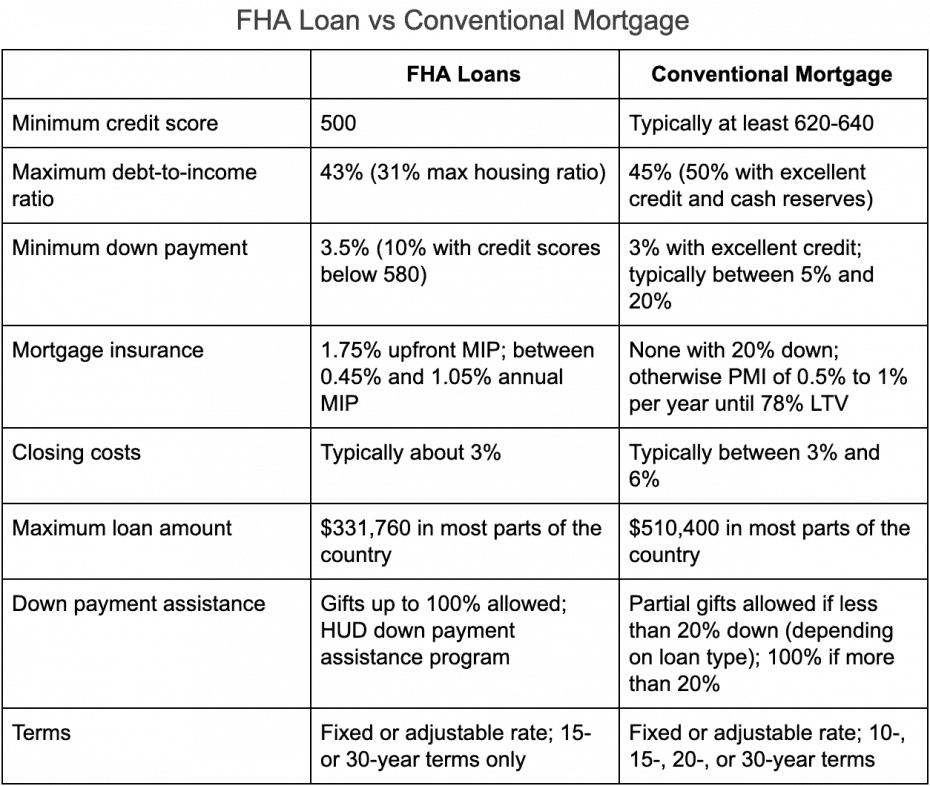

Government financing applications given by the fresh new Federal Construction Power (FHA) are also well-known and therefore are for sale in both repaired-rate and you may varying-rates structures. Generally, government mortgage programs are easier to be eligible for and get down advance payment requirements and additionally a lot more flexible credit standards. But not, instance antique mortgage apps, FHA financing has actually specific charges and costs for the all of all of them.

In advance wanting property, attempt to know how much you can afford, together with best method to do that is to obtain prequalified for your financing. Of several realtors would like you becoming prequalified so they can show you home in your budget.

To track down prequalified, click the link. You can even fool around with our house Value Calculator observe the fresh finances out-of house just be looking at.

The expression is the lifetime that you’re going to generate payments in your real estate loan financing. Brand new expanded the definition of, the reduced their payment per month could well be. That have a longer name, additionally spend much more within the attention along the longevity of the loan.

The pace is the ratio from financing that’s energized given that desire into the borrower, generally speaking indicated once the an annual portion of the loan the. Its accustomed assess their month-to-month homeloan payment. The higher the speed with the a certain financing, the higher the payment per month could well be, and you can the other way around. Which have a fixed-speed mortgage, the speed on your loan can’t ever alter. Having an arm, not, the pace is linked so you’re able to an inventory of great interest prices published by a third-class, such as the authorities. Because this index transform over time, thus have a tendency to the interest rate accustomed calculate your monthly financial fee.

The fresh new apr otherwise Annual percentage rate informs you the fresh new projected loans Lowndesboro pricing of the mortgage, which includes the pace or other initial fees which you pay for the mortgage (such dismiss points and you will origination fees)paring APRs will help you understand and that financing is actually the latest best value to you personally whenever all prices are sensed.

Financial 101

To shop for a property or mortgage refinancing necessitates the assistance of lots of people (the lending company to have operating the borrowed funds, the label company to possess verifying possession of the home, brand new appraiser to own determining the worth of your house, etcetera.). All the costs from all of these properties is actually together entitled closing can cost you. These types of costs aren’t complete from the 2-3% of your own amount borrowed, but they might be higher.

Any of these costs are controlled by the financial institution, because the rest is controlled by other companies that are concerned on the mortgage techniques. The closing costs can either be paid up-front side, or perhaps in some examples, the lending company can truly add these to extent youre borrowing. Your bank tend to details these can cost you during the financing Guess, to get an atmosphere based on how far you’ll have to pay if the mortgage shuts. Their mortgage loan manager will be sending you the guess contained in this step three working days out of operating the application and help you to definitely discover what you are paying for.

Basically, your monthly mortgage payment comes with dominating and you will interest. Possessions fees and you will homeowner’s insurance rates may also be collected from the lender throughout your monthly homeloan payment, held in an escrow account, right after which paid off for you in the event the repayments was owed. Escrow actually mode the brand new holding out-of records and cash from the good simple third party.

Your property fees and you may homeowner’s insurance coverage is generally reassessed on a yearly basis during the an annual escrow reassessment period. Your own mortgage servicer commonly recalculate what your the latest monthly payments often become and you can reveal how much cash you borrowed from. These money would be added to escrow and you may paid back on your account.