Lower than particular criteria, one may obtain financing away from an excellent 403(b) plan

But it’s important to performs directly into package administrator so you’re able to ensure that the mortgage is not regarded as an early shipment. If it takes place, brand new shipment would-be advertised due to the fact money, while brand new accountholder are not as much as age 59 step 1/dos, following an effective ten% income tax penalty may use.

403(b) Mortgage Constraints

In the event the a keen employer’s 403(b) annuity bundle has the benefit of which work with, you can receive that loan out-of an account in advance of age 59 1/dos versus taking on a punishment. Although not, if for example the provisions of your loan are not honored, the loan are considered a shipments. Most income tax punishment may pertain when your accountholder is not many years 59 1/dos or earlier.

Money into loan should be made every quarter (at a minimum). The loan agreement may possibly provide to have a beneficial around three-few days grace period, that will make it an associate so you’re able to suspend money throughout the army service.

The phrase of your mortgage may not go beyond five years, except if the money is used towards the acquisition of a primary house.

If one does not spend the money for matter due, otherwise defaults into that loan, the internal Money Service (IRS) will get rid of the whole financing (not just the remaining harmony) as a shipments. For the reason that condition, the new 10% early withdrawal penalty usually incorporate.

Hardship Distributions

Possible obtain an adversity distribution of a great 403(b) bundle. Please be aware, it is not sensed a trouble financing; alternatively its noticed a delivery. Hardships should be presented, and you will bring about an enthusiastic “instant and you may big” monetary load. Failure in order to satisfy this type of requirements can jeopardize the fresh new position of your income tax sheltered annuity.

Adversity Delivery Laws

To help you just take a 403(b) hardship distribution, this new accountholder would need to show they are lower than significant financial distress, and also have few other feasible tips available to deal with you to load. Examples of deductible hardships tend to be:

These a number of difficulty distributions is actually anticipate by an enthusiastic Internal revenue service provision that requires companies to take care of a safe harbor withdrawal only in cases where discover a primary and you may hefty financial you want otherwise load.

Difficulty Distributions

Take note you to hardship distributions aren’t necessarily excused regarding an most ten% tax punishment. On top of that, distributions of this type is actually at the mercy of federal tax, because they’re considered ordinary income. Bundle people can certainly be asked in order to approve he has no most other technique for flexible it burden, like the probability of bringing financing (in addition to an effective 403(b) loan). Members might be banned out-of leading to the plan for 6 months. In the end, you can’t manage a beneficial 403(b) rollover on the a special senior years plan otherwise IRA utilizing the money from a hardship delivery.

Borrowing from the bank Money from a great 403(b)

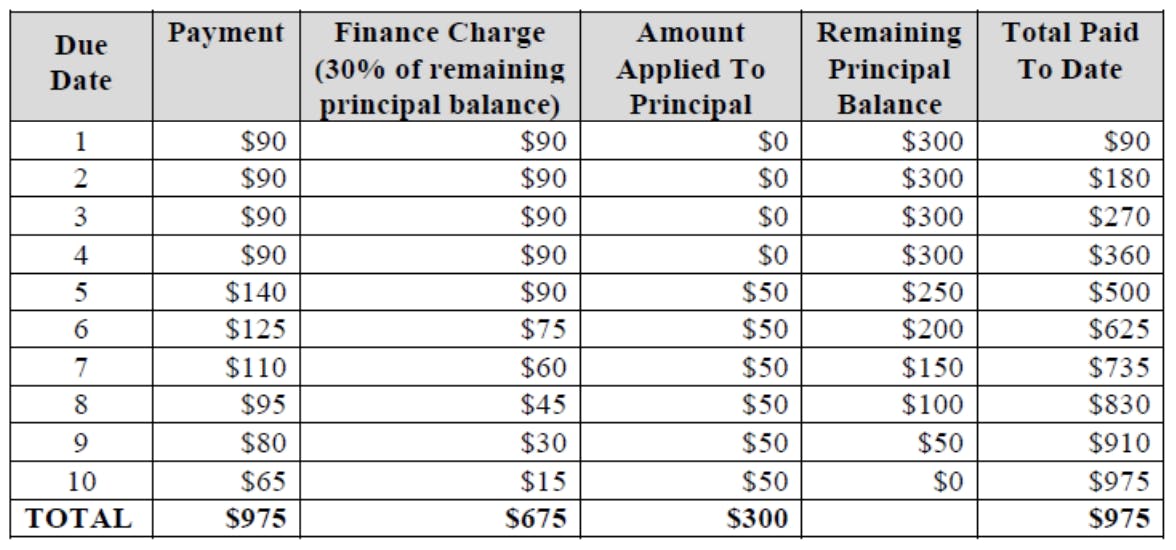

Before you make one choice to help you borrow off a beneficial 403(b) account, whether it’s that loan or adversity distribution, it is very important fatigue every other alternatives also taking right out a beneficial consumer loan. Think about, this can be credit facing a safe senior years afterwards so you can purchase costs today, which is not a beneficial behavior. Such as for example, in the event the Sally Saver requires good 403(b) loan, next she’s going to feel banned from engaging in their own bundle until every cash is paid off. When the their particular manager fits her benefits, following the woman is forgotten you to definitely benefit. In the event that she ultimately find she do not pay back the mortgage, after that she’ll are obligated to pay tax into the funds and spend a good ten% early detachment punishment. At exactly the same time, if the debtor chooses to hop out their employer until the loan is actually repaid, they truly are needed to quickly pay-off the complete loan otherwise be facing taxation charges. Borrowing from the bank funds from good 403(b) package shouldn’t be an easy decision. Indeed, it is advisable to visit a tax top-notch or financial prior to making so it decision. The private mortgage hand calculators on this web site allow clients to help you explain to you some issues having fun with solution sourced elements of currency, helping them to see what the newest monthly installments would-be under each solution.

Mentor Rules

Plan sponsors provides certain obligations with regards to currency lent off a 403(b) account. Failure to understand and you can statement finance that do not follow the aforementioned laws and regulations is considered just like the a taxable shipping, that should be said towards worker since money. This may are present if the an employee keeps more than $50,000 into the a fantastic loans with the boss, or the staff fails to generate prompt costs towards the bad debts. At that point, the newest plan’s mentor need to statement the mortgage while the a taxable distribution to your staff.