Loan providers thoroughly check into a good home’s HOA and you may focus on an overall chance review for the relationship

They could take a look at exactly how financially steady the connection is actually, if your society is really-constructed and has now space getting increases, and in case its best to store their really worth.

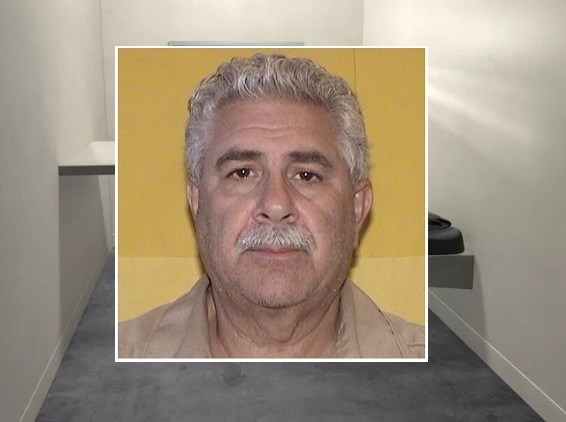

Unnecessary little details amount because if the newest HOA happens crappy, or isn’t treated securely, otherwise does not have any money, nobody wants to purchase indeed there, states Hernandez.

Hernandez further shows you lenders mostly glance at the loans specialist-rated month-to-month to have solitary-members of the family house and you will townhomes, however with condos the procedure is a great deal more on it.

The latest finance for the condominiums are valued in another way and it also will not most has anything to perform with the HOA, claims Hernandez. The mortgage varies as they are perceived as riskier. A few of the cause has to do with new HOA are therefore mixed up in stability of the house. Therefore, if you have a great condo, the fresh HOA very much controls the area – the way it seems, will there be deferred repairs, could it be an effective HOA board that is and also make sound conclusion?

On top of that, having condos, lenders additionally require management companies doing special questionnaires. Hernandez shares some situations of your key topics these surveys address:

- Proportion off owner tenant versus financing features (resource features is regarded as riskier)

- Lenders glance at HOAs where fifteen% otherwise greater out of owners are outstanding to their homeowners’ expenses once the increased financial threats. The greater new part of delinquencies, the reduced the new HOA’s put aside funds is, which locations a heightened monetary stress on owners to keep up the brand new people

- Number of commercial space in the area

- Association’s overall set aside loans

- Constant litigation otherwise huge costs springing up in the community

- In the event the HOA have specific insurance policies models, particularly Fidelity Thread Insurance policies, hence covers the latest HOA’s panel https://paydayloanalabama.com/ballplay/ from administrators up against lawsuits out of people

In the event that a loan provider rejects your application

What will happen if the a lender enjoys an issue with the new connection and rejects their demand? Does this indicate you have to hug your dream-house-to-become good-bye? Never. You can is actually another type of lender otherwise chat with the brand new HOA panel for ideas so you can banks obtained caused previously.

Tucci believes in the event that a buyer would like property plus it looks in the a beneficial standing definition, it is really not dilapidated otherwise rundown it’s beneficial to seriously follow the house or property from the investigating other capital possibilities.

HOAs will always be switching, states Tucci. You can find some other [association] presidents, and you can regulations and rules that have to be adjusted and you may modified.

HOA and you may escrow profile

After you get a property, their bank might developed an escrow membership. Within this account the lender collects a portion of your monthly loan commission to build a money set aside to pay for possessions fees and you may insurance policies.

Buyers often ponder if they can play with escrow account since most money for the HOA fees, but there are lots of complications with so it. Hernandez shows you that all loan providers won’t include HOA fees in the escrow profile due to the way dues try billed and you will paid down. Of several relationships expenses per year otherwise quarterly, therefore the charging you agenda differs from the month-to-month mortgage payment. And, the 2 repayments can not be lumped to one another while the HOA expenses was paid off right to this new connection, when you find yourself home loan repayments visit your lender.

There are certain loan providers which make exceptions having escrow account although not, it might possibly be practical to ask your financial whether it is something they supply.

HOA and taxation

There clearly was great news and you can not so great news in terms of HOA expenditures as well as how it gamble in the taxation. When you are renting a property otherwise using it once the a financial investment assets, their HOA fees can get matter while the a rental expenses and may getting tax deductible. not, people special investigations charge getting fixes, home improvements, or maintenance most likely won’t be considered.