Ideas on how to Qualify for A home loan From inside the Dallas

Dallas is just one of the fastest-increasing metropolitan areas in the usa. Brand new roaring cost savings, the lower cost of living, the good climate, and cool communities – just a few of many good reason why, on a yearly basis, tens of thousands of somebody and you will parents intend to call Dallas house.

If you’re considering to acquire a home from inside the Dallas in the near future, understanding the lowest mortgage certificates can help you finding the fresh new suitable credit system for your requirements.

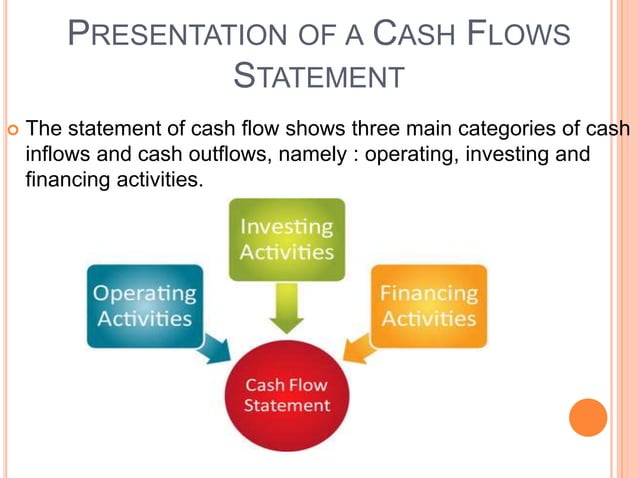

Qualification conditions to own a house mortgage will vary with regards to the particular out-of home loan you would like, but the following would be the minimum criteria for the most preferred kind of mortgage loans:

Advance payment

Really conventional mortgages you desire an excellent 10% 20% down-payment, even though some consumers will get be eligible for as low as 5%. In the event your down payment is below 20%, you will want mortgage insurance policies, and that covers the financial institution in the eventuality of a default. Once gaining 20% guarantee in your possessions, just be permitted terminate your own mortgage insurance rates.

Credit score and you can DTI

Conventional compliant mortgages typically require a credit rating of at least 620. However, specific loan providers may need a high score in the event the other indicators, particularly a top financial obligation-to-income, boost your borrowing from the bank exposure.

Really loan providers you need a good DTI proportion from forty-five % or smaller; however, Fannie mae lets DTIs as high as 50% into fund underwritten with regards to automatic Desktop computer Underwriter program, which have compensating factors. Manually underwritten loans have to have a good DTI out-of lower than thirty-six%.

Loan-to-Well worth Ratio

Loan-to-worthy of percentages getting solitary-members of the family primary homes don’t surpass 97 percent getting fixed-rates fund to own highly-accredited consumers, 95 % getting adjustable-rates mortgages, and 80 % for cash-away refinances. Traditional finance essentially need a beneficial 5% advance payment, while FHA needs good step three.5% down .

Earnings and you may A position

In the event that working, you are going to need to establish latest pay stubs, one https://cashadvancecompass.com/payday-loans-al/ or two months’ worth of financial statements, as well as 2 years’ value of W-2s. Whenever you are mind-operating, you ought to promote one or two years’ worth of individual and company income tax output, their latest statement of finance, and you can three months’ providers bank statements.

Specific home loans, such as those guaranteed from the authorities, such as for instance FHA and you will Virtual assistant fund, possess reduce payment and credit rating certificates. Yet not, you need to see loan-specific criteria so you’re able to qualify for these home loan versions.

Dallas, Tx Mortgage lender

Are you currently in the market for an alternate house during the Dallas? Want to work on an informed mortgage lender during the Dallas? Look absolutely no further; Capital Mortgage loan even offers some financial program you to suits all the customer’s you need.

Only a few mortgage lenders when you look at the Dallas are identical. Once the better mortgage lender when you look at the Dallas, Financial support Mortgage loan also provides an adaptable underwriting guideline suitable for complement people borrower. Out-of reduced-interest levels and low charges to help you an in-date closing, i get satisfaction when you look at the getting ideal-notch support service if you find yourself constantly fulfilling our very own work deadlines.

Willing to Sign up for A Dallas Mortgage ?

Whether or not purchasing your very first otherwise second household, all of our Money Home Home loan can help you understand your perfect of homeownership for the Dallas.

Within Financing Mortgage, we all know the problems of having financing to have a house inside the Dallas, especially for first-go out buyers. With these book virtue due to the fact an immediate lending company regarding the county, we can assist you in protecting the ideal home loan and you may purchasing the top house for you.

We have the products and you will tips in order to speed the loan app, underwriting, and you can money processes. You could potentially trust you to have punctual and smooth home loan applications and you can closings.

Let us talk about their mortgage choices. Contact all of us today from the 214-372-0015 , or make use of the equipment on this site.