However, when you are providing this mortgage, qualification and you can paperwork conditions are less restrictive than simply a vintage mortgage

Once you make an application for a Virtual assistant loan, your own Virtual assistant mortgage certificate from Qualifications, appearing even when you qualify for an exception to this rule less than that of categories significantly more than, could well be examined

One of the primary partners possibilities veterans and you can effective-responsibility military players imagine getting a property pick is the right to try to get a Virtual assistant real estate loan. This type of mortgage loans was backed by the fresh new You.S. Agencies out of Seasoned Circumstances (VA). Together with, players do not need to pay for people advance payment otherwise pricey mortgage insurance.

However, fees for an effective Va loan may differ, according to should it be the original mortgage or after that funds

But there is however one to commission the majority of people exactly who rating a great Va-backed mortgage loan need to pay: the newest Va money payment. The fresh Virtual assistant resource commission inside smoother terms and conditions try a one-day fee for getting a new or refinanced Va-backed mortgage. The objective of the fresh new Virtual assistant investment fee is for cover regarding subsidizing that loan that will not want far eligibility and you may files criteria and home loan insurance rates.

Extremely veterans and you will active-obligations military users would have to pay the Virtual assistant financial support percentage whenever obtaining a mortgage loan, but there are several exemptions. This will indeed apply at you for folks who match certainly one of new requirements less than:

- Whenever you are an assistance affiliate having a memorandum otherwise proposed get toward otherwise before mortgage closure go out

- When you are an energetic-duty service associate provided the fresh Purple Cardiovascular system to your or through to the mortgage closing time

- If you’re paid to possess a help-connected disability

- While the enduring spouse out-of a veteran otherwise effective-obligations army affiliate who missing his/their own lives through the provider, otherwise died from handicap associated with solution, or at least entirely handicapped during the solution, while have the Dependence and Indemnity Compensation (DIC)

- For many who receive advancing years otherwise energetic-duty spend in the place of provider-connected Virtual assistant compensation you are qualified to receive. Your credit history could well be assessed during app.

Brand new Va money payment is, in a number of means, more for all. That it huge difference will be based upon multiple items associated with your very own financial situation $255 payday loans online same day Alabama. How does the newest Virtual assistant financing fee calculator work? The calculator will assist you to understand the cost number that would apply at the particular assets you happen to be to acquire.

While you are a routine military member no advance payment, then your money payment have a tendency to instantly feel 2.3% of your own first loan, right after which step 3.6% of your own next of these. However, if you plan while making a deposit, the cost can be quicker to one.65% for everyone finance having a down-payment ranging from 5 and 10%. And is also next smaller to a single.4% to have regular armed forces members who can generate a down fee of more than 10%.

These are authorities-backed Va mortgages to own pros and you will productive-duty army members, its a step that gives pros and soldiers an unbelievable financial alternative. Although bodies charge many borrowers a financing percentage to counterbalance the expenses of your system. Thankfully, certain pros qualify for investment percentage exemptions, and on additional hands, there is certainly an easy way to look for a refund if it happens which you have become improperly energized.

The application form several months needs time to work, so, during that several months, a seasoned may have repaid the brand new funding payment, and located an exclusion after. Inside particular condition, you could potentially receive a reimbursement.

By way of that the fresh new funding commission try paid down physically towards Va, it is the Va which can, in the owed direction, decide no matter if you obtain a reimbursement. not, to start the newest refund procedure, you may either contact the new Va mortgage heart on your part otherwise get in touch with your own financial personally.

The biggest factor that determines the fresh new capital commission a debtor usually pay ‘s the down-payment. Along with circumstances by which individuals commonly expected to pay good down payment, the complete loan amount goes into notice.

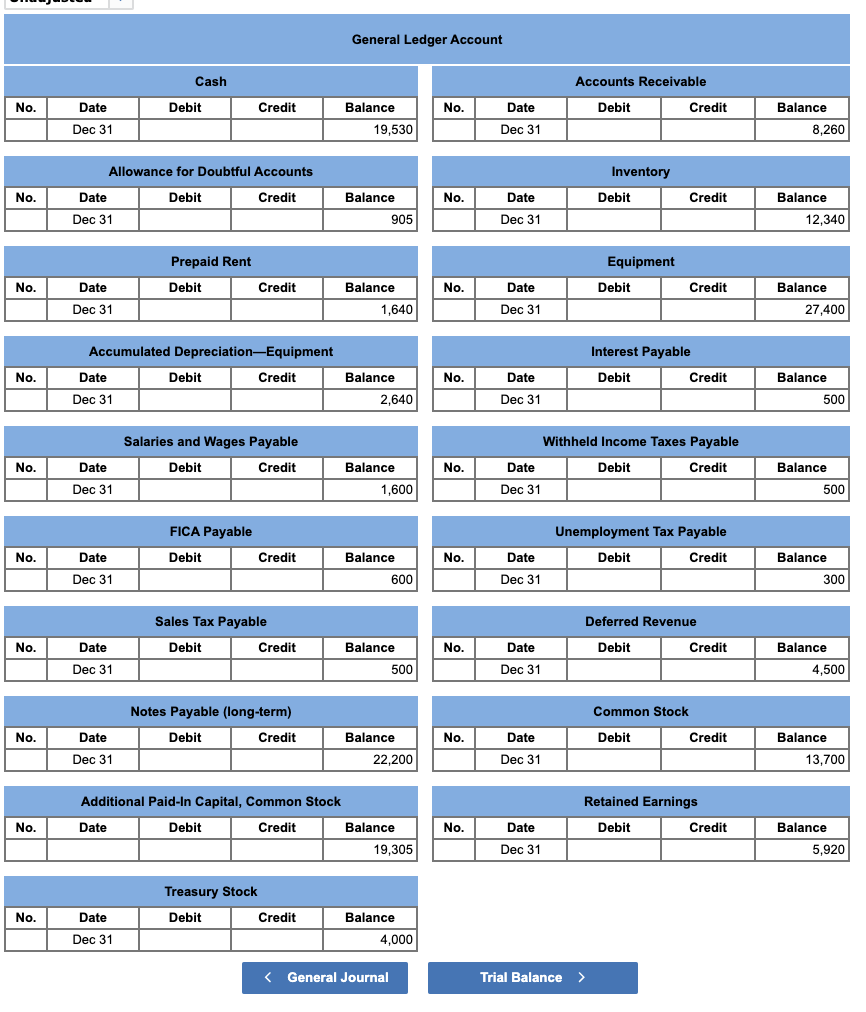

The second graph reveals the current mortgage resource fee to own experts and you may effective-obligation armed forces people also set aside people and national shields.

You will need to observe that regarding forty% of all of the experts is exempt out-of make payment on Virtual assistant financial support payment. This shows not all borrower needs to afford the Virtual assistant financing investment commission. To avoid make payment on Virtual assistant mortgage investment fee, you will want to find out if you are qualified to receive a keen exception to this rule, since regulations are being altered sporadically. Take a look at over exemption checklist to understand for folks who end up in the kinds.