Can i refinance my personal HELOC having another type of lender?

Whenever i mentioned before, that one is expensive and high-risk. You can easily pay alot more attention full or take on a whole lot more personal debt. Whenever your money commonly under control, you risk dropping your house if you’re unable to generate money in the HELOC repayment months, that is notably high. It may be time for you to repay your HELOC.

You can consider refinancing good HELOC in the event the credit score and you may money has significantly increased since big date you got the loan.

Do not forget to seek information and you can guess how much way more financial obligation you’ll end up trying out and just how far their monthly installments would-be.

Solutions in order to HELOC Mortgage Re-finance

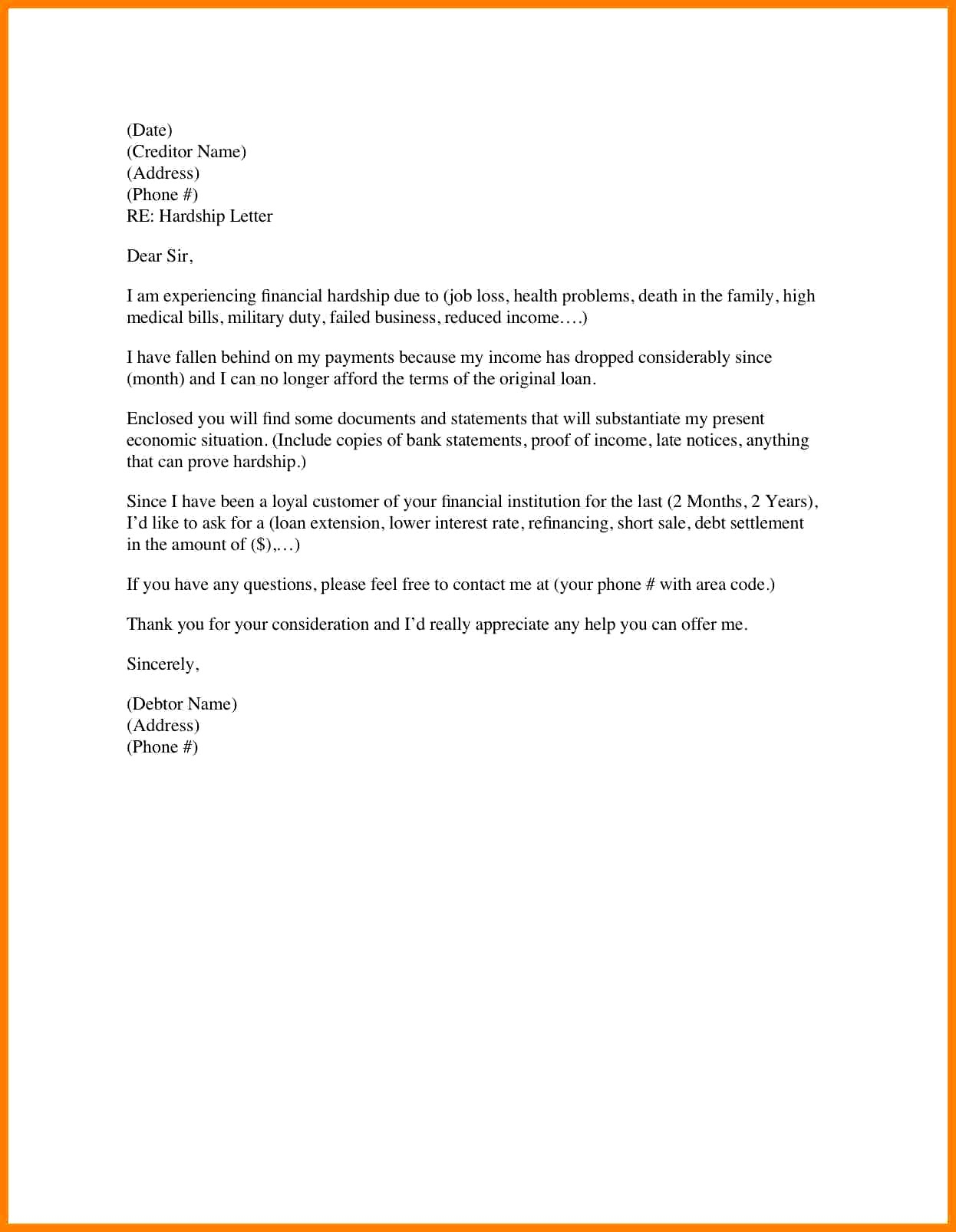

Imagine if that you don’t be eligible for a re-finance? What if you won’t want to re-finance? In such cases, it is possible to consult a loan amendment together with your financial.

If you find yourself not able to improve monthly obligations on the HELOC, financing modification can get let the HELOC repayments to suit your finances and possibly increase their cost identity.

For instance, specific lenders will get believe current financial hardship such a healthcare emergency or death of a position. Remember that for example a modification will apply to the borrowing from the bank score negatively.

Another type of solution was obtaining an unsecured loan. This financing are certain to get its own standards and criteria and will not become safeguarded by the home. not, the eye costs is greater than financing covered because of the a house.

You can make use of the personal financing money to pay off the latest HELOC equilibrium if recognized. Remember that he HELOC interest levels are usually lower than just unsecured loans.

If you think you can get better standards with a new mortgage, particularly if you’ve increased their creditworthiness, refinancing HELOC may be wise.

You to definitely great benefit in order to a beneficial HELOC refinance is the solution to pick appeal-simply money regarding the draw several months. This allows to have credit a lot of currency over a keen longer timeframe when you find yourself only satisfying limited commission loans.

However, once the installment kicks off, your own monthly payment have a tendency to intensify, necessitating costs with the both principal mortgage equilibrium and you may notice. At this juncture, examining HELOC refinance choice which can establish helpful.

Frequently asked questions On Refinancing HELOCs

Refinancing HELOC contours that have another financial is possible, nevertheless generally speaking relates to techniques similar to those of acquiring a good the new HELOC. You will have to get a separate mortgage, that has a credit assessment, assessment, or any other underwriting actions. Request good HELOC without assessment. It is necessary to compare HELOC terms, draw months, fees months, rates of interest, closing costs and you will charges within current household collateral distinct credit and you will possible HELOC refinance choices to guarantee it’s economically of good use.

Do you really re-finance an excellent HELOC towards the a mortgage?

Another well-known choice is to re-finance an excellent HELOC towards the a money away refinance including a predetermined-price. When you favor this package, you are generally refinancing the HELOC along with your present first home loan for starters this new mortgage and additional cash out that comes in order to your just like the a lump sum payment in the event the loan closes.

To be entitled to a money-aside re-finance, the loan number should be sufficient to safeguards both the home loan and HELOC balance. Key factors to check whenever refinancing a great HELOC is:

Financial Prices: In the event the newest rates of interest is below your existing home loan price, an earnings-out refinance would be useful. Yet not, in the event the cost keeps risen, the brand new financial you are going to carry a high rate, leading to enhanced monthly payments.

Financing Settlement costs: These could vary from dos% in order to 6% of new amount borrowed, probably diminishing the many benefits of refinancing.

Loan so you’re able to Value: Refinancing a HELOC can get beat home equity, along with case of a fall within the property beliefs, the mortgage can become under water. Really lenders are seeking 20 to twenty-five% readily available equity so you can re-finance good HELOC to the home financing when you find yourself researching more cash return.