Borrowing from the bank Electricity: An alternative key advantage of home loan is the fact it can help so you’re able to improve borrowing from the bank energy of the individuals

twenty-three. Taxation Deduction: Which have home loans, home owners also are eligible for tax deduction to the payment of the eye towards home loans. These deductions bring monetary rescue on the property owners by the reducing the full taxation accountability.

four. Secure Homes Cost: When comparing to living on the rent, the spot where the book try enhanced sporadically, in the home loan, discover an availability of fixed price EMIs in which here will come stability regarding the construction prices. The latest EMI stays lingering for the complete lifetime of the house loan, before the several months there aren’t any part-costs otherwise people improvement made in the fresh terms and conditions. Ergo, the homeowners normally bundle the budget appropriately having a stale casing costs.

5. Appreciation: The true home field is just one of the quickest increasing sectors off India, and therefore the value of the house on which a property loan are drawn is additionally planning to improve over the years. This may bring about extreme financial increases during promoting the property.

The latest steps regarding a home loan application procedure are the adopting the

6. Our home security which had been dependent can also be used because collateral if you are making an application for every click this link here now other loan. Our home collateral funds or assets mortgage can be used having several purposes comprising advanced schooling, wedding events, scientific debts, and you will travel expedition, etc.

7. Balances and you may Safeguards: Which have homeownership, truth be told there plus arrives a feeling of balance and you can defense. Once you know that you really have an area which might be titled yours, you have the versatility to make alter to help you they, modify it as per their desire to, to make extreme decisions for the assets, all of it leads to a feeling of shelter and you will balance.

As well as the advantages of a home loan, there are numerous requirements particularly make payment on financial EMI for the some time keeping sufficient balance on the monthly payments. Before you take a mortgage, it’s always best to look at your credit history, check your home loan qualifications, and calculate home loan EMI ahead to possess without headaches approvals.

Mortgage Software Techniques-

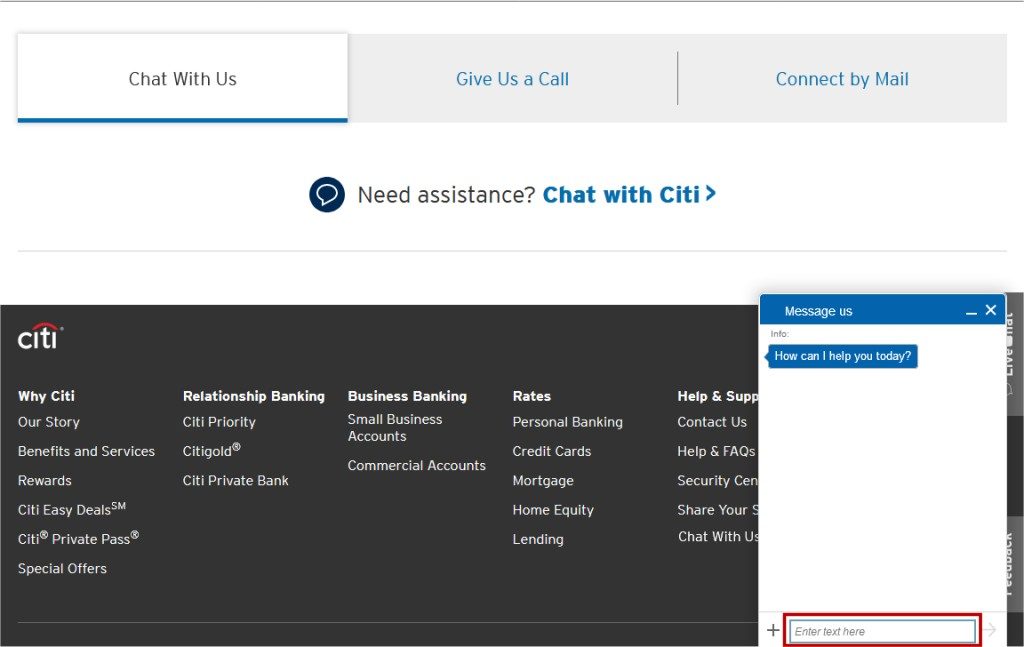

Our home loan application processes enjoys individuals steps that individuals need to check out while they sign up for home financing.

Before applying to have a mortgage, it is important to research your finances and exactly how far month-to-month EMI you can afford for the said of repaired monthly costs, earnings, or any other obligations.

Credit history takes on a key point yourself financing recognition procedure. Should your credit history is actually large, discover chance that you could get better financing words. Concurrently, you should work at any difficulty that can myself otherwise ultimately harm your credit score. You’ll be able to view credit score on the internet to arrange your self before the start of our home application for the loan process.

Looking after the newest customers’ need, you can find readily available customized and you can several economic choice. You might mention more mortgage products and is also find the you to that fits your preferences.

As well as checking your credit score and you will selecting the loan choice, its of utmost requirement to decide a home. Before you start to the mortgage app processes, your choice of a property required. Since the property is selected and you can closed, you could reach out to the financial institution for its worth evaluation.

One of several extreme steps in our home application for the loan techniques is to be obvious on what data files is needed for property and you may if this type of data are available to your or not. A number of the key documents necessary for a mortgage consist of Mode 16, bank statements, paycheck slips, tax statements, and you can right & updated details connected with your financial situation and you can property.