Resources Whenever Switching to some other Mortgage Servicer

And you may need certainly to work punctual here. The existing and you will the maintenance companies are merely needed to promote your fifteen days of notice until the this new mortgage servicer requires over.

That doesn’t mean you should buy punished if you are sluggish so you’re able to make changes. For folks who accidentally create a payment into the old mortgage servicer, they need to redirect they to your the fresh providers (prove which, though). And you may laws decides if you happen to be later to expend your brand new servicer in the 1st 60 days pursuing the transfer, they can’t ask you for a late payment or eradicate the fresh percentage because later (inside your credit rating). Thus there’s some great pillow made in having consumers swapping to a separate financial servicer.

If you were recently notified that mortgage servicer is changing hand, you can require some making that it changeover given that state-100 % free as possible:

- Mention the initial go out when payment is due to your brand-new servicer. Essentially, it’s the earliest deadline once you get informed of one’s change. If you get a page on send alerting you inside the mid-ple, you will likely need to make your first commission toward new mortgage servicer to your April step one.

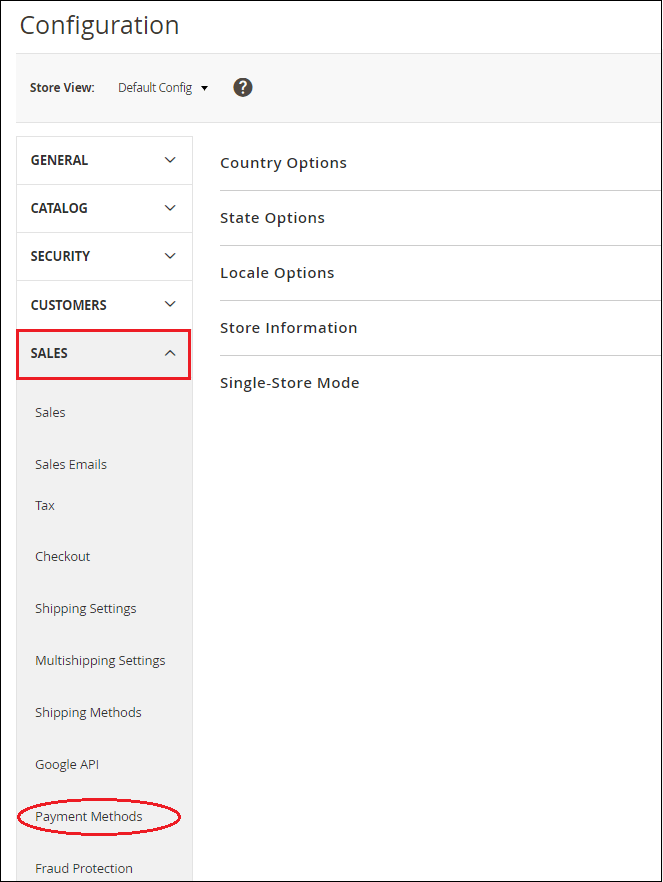

- Install https://paydayloanalabama.com/steele/ payment into the the servicer immediately. If you’d like so you’re able to autopay the financial, particularly, have that depending to your the brand new business. Or you always send a, figure out the latest address to transmit they.

- Double-check your first commission. Make sure you can view that money has leftover the account hence this new servicer has already established it.

- Make certain everything transmits over. You truly involve some money accumulated on your mortgage’s escrow account to cover fees and insurance policies. Double-check that an entire count becomes directed out over new servicer.

- Are the the newest servicer towards the contact number. You don’t want one financial announcements to finish up on the junk e-mail folder.

- Check out your house insurance coverage. In some cases, you’ll want to replace the mortgagee term to add the servicer’s facts.

A different mortgage servicer can mean particular added really works. But sometimes, whenever you are happy, the upkeep legal rights gets ended up selling so you can a buddies with greatest customer care and you may a much more useful site.

Ought i Avoid My Mortgage Of Being sold?

Always, zero. So it routine about mortgage industry is court and prevalent. In reality, you’ll likely come across a condition making it possible for it about words and you can standards of one’s financial price. That being said, whether your newest lender offers the repair legal rights to another company, they cannot change something except that where you upload their monthly repayments. The regards to the loan need to remain the fresh exact same.

How many times Normally A mortgage Servicer Changes?

There’s absolutely no restrict positioned. When you’re servicers need follow particular regulations around factors including simply how much observe they give, they are able to commercially sell their maintenance rights whenever they wanted. And the business one to purchases them next can do an equivalent.

How come My personal Home loan Repair Providers Keep Changing?

This has nothing to do with your because a borrower otherwise your unique loan. Instead, it simply implies that your own prior servicer watched benefit into the attempting to sell, and other agencies was interested in purchasing your upkeep rights.

An element of the troubles with a brand new financial servicer is inspired by the newest have to reroute commission. Instance, for those who have autopay developed together with your old mortgage lender, you will probably need certainly to lay one to right up once more with the the brand new company. Having said that, some servicers have begun to go over trick facts such ACH transfer information.