Best Line covered credit line debtor standards

You will still need to render an individual make certain whether or not zero equity is required. To the Small company Advantage credit line, for each and every owner bringing a hope must have about 20% interest, with signing citizens along carrying 51% interest in the firm or more.

SBA eight(a) money

SBA seven(a) financing is actually Anniston bad credit loans title money that can be used to own a number of various intentions. Wells Fargo lines common uses of their SBA 7(a) finance specifically since:

- Business buy

- Lover purchase-out

- Broadening your business to another

- A residential property purchases

- Devices commands

The most you could potentially obtain try $5,000,000. Terms is really as much time since the 3 hundred days (or 25 years) when you are utilizing the financing getting commercial a residential property. If not, the newest maximum label are 120 months (a decade). Rates should be both fixed or changeable, and therefore are at the mercy of SBA interest maximums. New SBA really does costs costs to help you banking institutions in the event it facts these types of money, and is very possible that you will see Wells Fargo pass these costs on to you because the borrower, regardless of if Wells Fargo cannot in public places reveal costs for SBA products.

SBA 504/CDC funds

SBA 504 money are manufactured for construction or a residential property intentions. During the Wells Fargo, they are utilized to possess build, to find devices, land or assets. Extent you could potentially use varies by your created have fun with. Wells Fargo commonly back-up into basic $10 mil; then a new $5 million might be provided by an authorized Innovation Providers. Yet not, whenever you are a small company otherwise taking care of a power endeavor, you will be qualified to receive a maximum off $5.5 billion about Certified Creativity Company.

Costs are set by the SBA, and are generally currently to step 3.00%. Limitation mortgage words is 120 days (ten years) to own machinery or devices requests. New maximum leaps to 300 months (25 years) if you’re utilising the resource to have framework or any other commercial real property endeavors. Once again, this might be one to product where you are planning see SBA fees passed away to you personally due to the fact debtor, however, the individuals charges are not expose in advance of application.

Health care routine financing

For many who work on a health practice, Wells Fargo does offer a large suite regarding lending products in order to fulfill your own investment requires. Medical care lending products is:

- Identity fund

- Working-capital financing

- Personal lines of credit

- Products financing

Wells Fargo debtor criteria

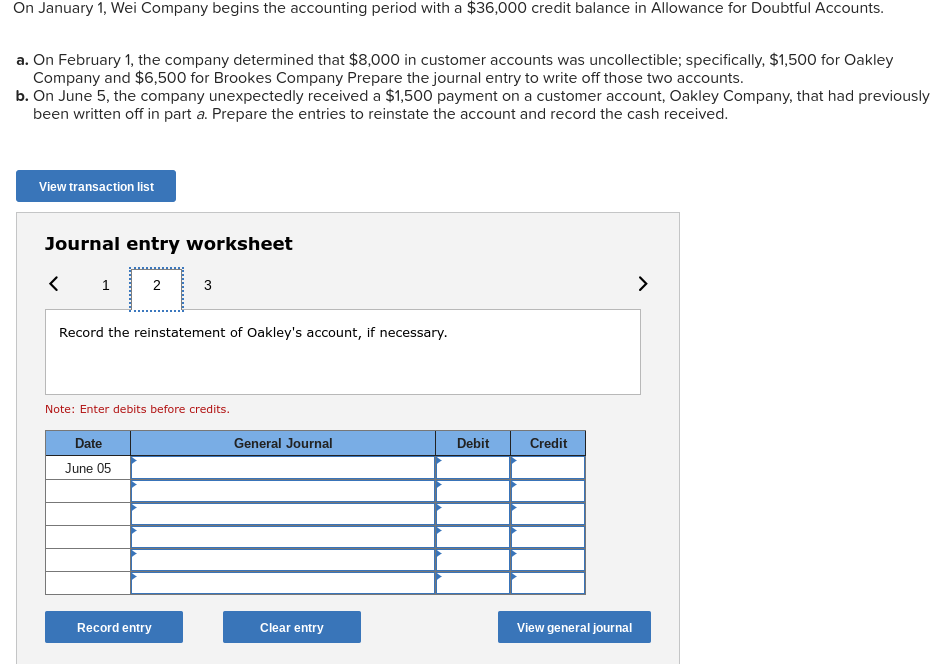

Wells Fargo offers glimpses of their underwriting requirements, but it’s difficult to get an entire visualize when it comes down to sort of equipment. Let’s browse the information it does provide for ways to get a business financing and you can personal line of credit.

Unsecured credit line borrower requirements

Having BusinessLine or Small company Advantage lines of credit, your normally you need a credit rating with a minimum of 680 so you can be considered. If you’ve been in operation for a couple of age or maybe more, you will end up eligible to sign up for the latest BusinessLine equipment, in case you’re a newer team that have fewer than 24 months under your belt you are best suited for the little Company Virtue credit line. Yearly money standards commonly announced of these facts.

Minimal credit history standards aren’t announced for it equipment, and lowest amount of time in business conditions is actually presumably a couple of years just like the you happen to be required your own earlier in the day 2 years off team tax statements after you incorporate. Wells Fargo do express that qualifying organizations have yearly conversion process ranging from $2 billion and you may $10 mil.

SBA financing borrower requirements

Wells Fargo doesn’t publicly share of a lot minimum requirements for SBA seven(a) and you will 504/CDC money, but minimal borrowing from the bank standards set from the SBA are a good place to start your research. Wells Fargo really does display certain maximum limits to own SBA name financing consumers, even if. The business’ web worthy of is anticipated getting lower than $fifteen mil, as well as the mediocre net gain will likely be below $5 million.