Just how was a land Loan Distinctive from A mortgage inside Asia?

Due to the fact time immemorial, home happens to be a prime method to own funding. You will find some good reason why you’ll be able to consider using for the belongings plots in the India. Knowledge Functions, the best home providers within the Chennai now offers some pointers and you can tips on less than blogs to the financing inside the land plots and into the some suggestions off property funds. He is

Land is a tangible advantage that does appreciate over the years, especially in portion with high demand. Therefore, it does serve as good hedge facing inflation, just like the worth of the fresh new residential property can increase collectively toward cost of living.

Residential property plots during the India, especially in metropolitan or semi-urban areas, often take pleasure in in the worthy of through the years due to factors such as for instance because the society gains and you will monetary advancement. As a result you might be able to sell this new land having an income down the road.

Committing to home plots of land will help diversify disregard the collection, whilst brings an option asset class so you can carries, securities, or other old-fashioned investment.

If you buy a plot of land following rent it away, you may be in a position to create passive income throughout the leasing income.

If you have a sight getting developing brand new residential property (elizabeth.grams., building a home or commercial possessions), investing in a parcel of land also provide a chance to take your vision to fruition.

You will need to remember that investing in belongings plots of land, like any capital, carries some amount of chance. It is preferable to closely consider carefully your financial requires and you will risk tolerance before making one resource behavior. Every so often, the best way to get a house be it a story out-of homes, a flat or the structure from an independent home is thru mortgage. Today if you are going to choose a land loan, you will want to think of particular activities.

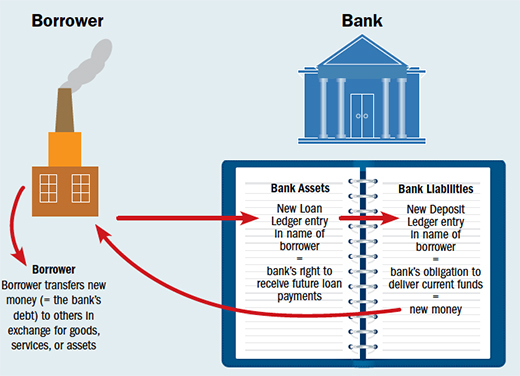

In the India, a secure loan is a type of mortgage that’s particularly designed to let people get plots. A mortgage, as well, was financing which is used to invest in the building otherwise purchase of a property. Listed below are some trick differences between land money and you may home loans within the India:

As stated earlier, home finance are specially made to funds the acquisition out of an effective parcel of land, while you are mortgage brokers are acclimatized to funds the construction or buy off property.

Residential property funds fundamentally have to have the block of land becoming ordered as equity towards financing, when you’re lenders need the family becoming constructed or bought just like the equity.

Residential property funds normally have higher interest rates compared to mortgage brokers, given that threat of default are high due to the use up all your of a concrete advantage (i.age., a house) so you can act as guarantee.

Property money are apt to have smaller tenures compared to the lenders, because structure or acquisition of property will take extended compared to purchase of a block of land.

Brand new eligibility conditions for home finance and you can mortgage brokers ple, loan providers might require a loans for bad credit Pensacola high credit history and a higher down payment for a land financing versus a home loan.

It is important to cautiously think about the differences between property funds and you will lenders and select the possibility that better suits you and financial issues. Furthermore a good idea to shop around and you may contrast now offers off multiple lenders to find the best price.

Think about the following the before you apply getting a story mortgage:

- The brand new lot of property needs to be centered inside business otherwise civil limits.

- The borrowed funds can’t be used to purchase belongings having agriculture.

- The house or property must not be centered near a commercial otherwise a village city.

- To fifteen years may elapse from the loan’s title.

- Simply fund always generate the house or property toward spot try qualified to receive an income tax deduction, and therefore deduction might only be studied following strengthening is done.

- You will found financing-to-worth (LTV) ratio all the way to 80%, which suggests a loan for approximately 70% of the cost of the property is supplied.

- You might get a story financing to find a story because of head allotment or to buy a selling patch according to the financial.

Features of a home loan

- To find a residential property all over the world, you could potentially obtain property financing.

- The latest period of the mortgage can move up to 3 decades

Home loan compared to Patch Financing Faq’s

No, though with facets in accordance, home loans and you may property finance are not the same. An area mortgage may only be used to buy a plot out of residential property for which you need to make a property, however, a mortgage can be used to pick a ready-to-move-internally, a home, otherwise a below-build possessions. You can’t play with a secure mortgage to shop for a prepared-to-move-in-house or an establishing website, and you also never explore home financing to get a plot.

Zero, this is simply not possible to transform a storyline loan into the a home loan. The debtor get make an application for loans including mixture financing, and this can be used to buy a plot of land and you may make a home around inside a particular time frame.

On Insights Features

Knowledge Characteristics has some of the greatest functions when you look at the Chennai and you may suburbs. In the event the people are selecting home available in Guduvanchery, DTCP Recognized Plots product sales when you look at the Oragadam, plots inside Chennai otherwise plots of land available in Maraimalai Nagar, upcoming Expertise Properties is the best real estate inside team when you look at the Chennai to take part in.

Expertise Qualities provides advanced houses, ranch belongings, and you will commercial land plots during the Chennai and its own outskirts. The values have become glamorous and you can sensible in expense. They likewise have link-ups having leading loan providers which means that, it is easy to score fund and you will money out-of including organizations.