Carry out Preapproved Also offers Affect Your credit score?

Preapproval to own a personal bank loan

As with playing cards, you can generally speaking discovered preapproval for a personal bank loan with just a smooth borrowing from the bank pull which would not apply to their credit ratings. An excellent preapproval to possess a personal bank loan is actually a way to determine if you are qualified to receive that loan prior to officially implementing and you will leading to a difficult borrowing from the bank inquiry.

In this case, the financial institution evaluations your own credit, income and other factors to determine if you meet the mortgage conditions. Concurrently, the lender offers a quotation of your own prospective amount borrowed look at more info, annual percentage rate (APR) and you may charge to the financing.

Generally, preapproved now offers, like those regarding creditors, cannot yourself impression your credit rating. However when you take on the new preapproval, the financial institution may review your credit history as part of an even more thorough final recognition processes, that will end up in a difficult query.

As the listed significantly more than, the fresh new preapproval process to own a home loan otherwise car loan requires a great hard borrowing inquiry. Borrowing inquiries keeps a low influence on your FICO Score ? , reducing they by the less than five points for most people.

Benefits of Taking Preapproved

Taking preapproved getting home financing can give you a concept of their credit limit so you’re able to buy a property otherwise car with full confidence. With a lender willing to finance your home buy makes you a more glamorous applicant so you’re able to a property seller.

- Brings an amount of certainty: When you discover a great preapproved provide, it is far from a guarantee from approval. But not, this means you meet with the credit issuer’s basic eligibility standards thus that you could stick to the app procedure that have at least certain count on.

- Zero injury to the get: Preapproval to own borrowing from the bank products besides mortgage loans simply needs a great softer credit remove to choose the qualifications having a charge card.

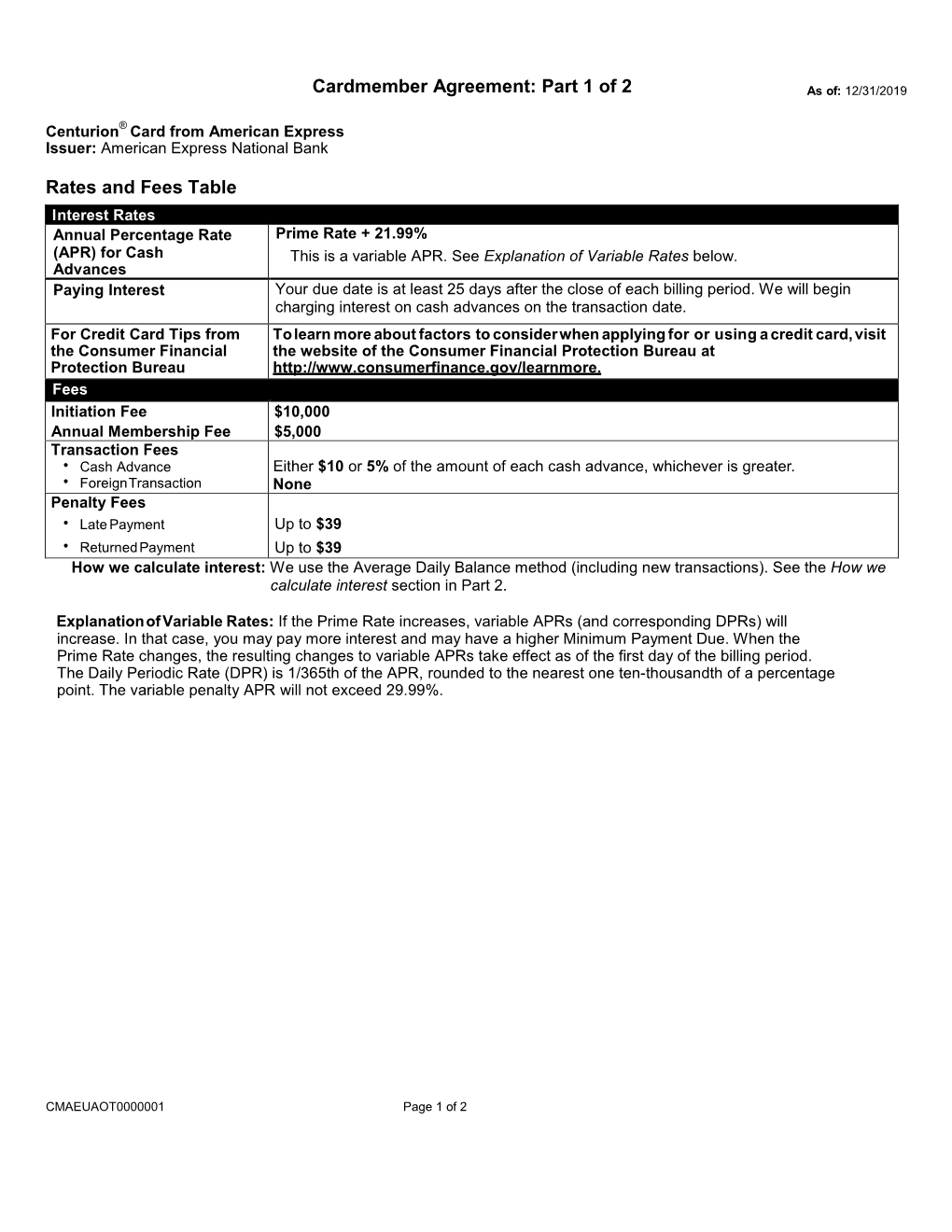

- Lenders compete for your business: Rather than searching for prospective playing cards to try to get, the good thing about preapproved even offers is that lenders can get posting them for your requirements. Just be sure you understand all card’s terms and conditions before you could implement formally.

- Cover anything from advertising: Of numerous charge card preapprovals provide valuable professionals particularly a great 0% introductory Annual percentage rate having a particular months, allowing you to repay highest-attract profile and you may reduce interest charge.

- You are able to incentives and you will perks: Certain card issuers draw in that create their borrowing card because of the giving you preapproved also provides that include an introductory bonus, perks and other rewards.

The way to get Preapproved getting Credit

With respect to the brand of borrowing from the bank you are trying to get, preapproval would-be good first step about borrowing approval process. It offers lenders and you will creditors a peek of the creditworthiness and you can will give you insight into the mortgage otherwise bank card you can located.

Naturally, preapproval does not verify invited for all the borrowing from the bank equipment; financial institutions and you may lenders must guarantee your data before you make good final choice.

- Look at your borrowing from the bank. Prior to starting the process, it seems sensible to locate a concept of where your own borrowing from the bank really stands. You can aquire a totally free duplicate of your Experian credit report and credit rating otherwise access your own account of all three significant credit agencies in the AnnualCreditReport. Checking their borrowing from the bank will not affect your credit score.

- Enhance your acceptance chance. When examining their credit history, pick people situations impacting your credit score or take the necessary steps to deal with all of them.

- Gather your personal files. Due to the fact finally acceptance at some point want verifying your details, make sure the advice you fill out getting preapproval are direct about initiate. Refer to your income stubs, income tax data files, membership comments and other essential data whenever entering your financial and you can a position pointers.