Interested in purchasing your very first home, but don’t are able to afford secured?

Smart Initiate First-time Home buyers try here for your requirements all the action of your ways in the home to invest in techniques. We’re specialists in Texas a property and down-payment guidance apps.

To find a property is a significant partnership. We know you could getting overrun. A beneficial kick off point is always to evaluate the benefits and disadvantages out of homeownership instead of renting , also understand the true costs regarding homeownership . ?We together with suggest that you sign up for CHFA’s Your Street Home monthly eNewsletter having potential homeowners. That it capital also offers an internal research the homebuying procedure, and frequently used terms and quick subject areas.

The fresh new S exists to assit our readers 7 days a beneficial times regarding 8am-6pm. The audience is willing to answer all issues and you will make suggestions through the entire procedure of homeownership.

Yes, per program has actually various other earnings restrictions and guidance. These could differ with respect to the program you use and the county you order during the. All of us away from masters goes overall of one’s options and you can few your toward system that every positives your.

Yes, most of the individuals need certainly to privately and you can by themselves sign in and over a prescription homebuyer group just before its mortgage loan closing go out. For every single debtor need receive their certification regarding achievement. Certificates try good to have 1 year; a borrower have to be under price to get a house before expiration of the certificate.

Yes. really apps require consumers to make the very least Investment (MFI) of $step 1,000 to your the purchase or re-finance of the property concurrently to virtually any kept closing costs otherwise downpayment conditions. That it share is measured included in the downpayment otherwise into settlement costs required for the loan. Merchandise of family unit members or other qualified source can be used to satisfy the minimum Borrower Monetary Share.

Wise Start will help couples you that have a community financial so you’re able to require down payment assistance apps. Our very own credit lovers will from the several facts also their monthly earnings, credit history, and you can financial obligation top to choose simply how much it is possible to be eligible for. Our lending couples will additionally assist you to discover the ideal program for your needs.

Very first time Home buyers

Yes, the fresh S helps homebuyers each and every day to achieve their requirements of getting a property. We makes use of Colorado’s Top lenders so you’re able to meets household people towards the program that is most beneficial to them inside the new purchasing process.

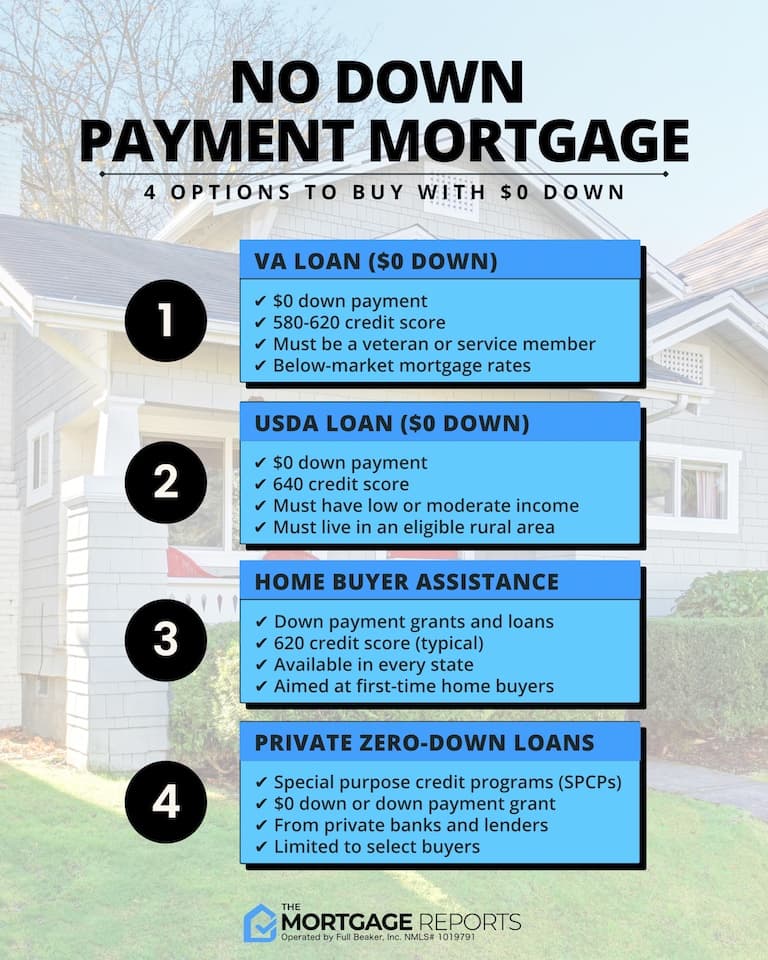

Eligible homebuyers using one of our advance payment assistance programs to finance their residence purchase can use the cash on their off fee and you can/otherwise closing costs. Even though you contribute on the a down-payment, you may still play with one of the alternatives below.

Payment regarding financing balance deferred up until specific incidents, such as rewards of one’s first mortgage or even the sale otherwise re-finance of the home.

Qualified first-time homeowners is discovered a house pick financing for the Tx. To qualify for the borrowed funds, borrowers need a credit history with a minimum of 620, done a great homebuyer studies class, and you will contribute no less than $step 1,000. As well, new borrower’s earnings can not exceed this new CHFA’s income limits. All of us are experts in locating the down-payment advice system that benefits your for your house pick when you look at the Colorado.

Real estate lenders

Traditional and you may FHA financing allow you to generate a down payment as low as step three.5 per cent of the purchase price therefore, into a great $600,000 house inside Colorado, that will be $18,000. Yet not all of us specialize in every readily available down payment guidelines which give doing cuatro% to your deposit and you can settlement costs.