Government-Recognized Mortgages: What they’re & How they Assist

- What is a government-recognized mortgage?

- Brands

- Pros

Member website links to the circumstances in this article come from people that compensate you (pick the advertiser disclosure with these set of people for more details). Although not, our feedback are our own. Observe we rates mortgages to type objective recommendations.

- In lieu of a normal home loan, a federal government-recognized home loan try secured or covered from the an authorities institution.

- You can find about three head types of government-recognized finance: Virtual assistant, USDA, and you may FHA.

- In many ways, its more straightforward to qualify for a national home loan than for a conventional home loan.

When you submit an application for a home loan, you will have to decide ranging from a couple of basic kind of funds: a federal government-supported mortgage and you may a conventional loan.

Government-backed mortgages are available to promote homeownership by creating they more affordable. They are available secured from the You.S. federal government, definition in the event that a borrower cannot generate costs, the us government often step up and you will cover a few of the lender’s loss. This enables lenders in order to agree consumers just who may not if not features been eligible.

When you have a low income, bad credit, or try a primary-time homebuyer or experienced, one of these mortgages may help generate homeownership easy for your. This is what to learn about this type of popular type of mortgages.

What exactly is a government-recognized financial?

A government-recognized home loan is a mortgage that is insured otherwise protected by the a national agencies. You’ll find mortgage loans supported by new Government Housing Management (that’s area of the Us Company out-of Casing and you may Urban Development), United states Agency from Agriculture (USDA), and/or Us Company of Pros Items.

The new part regarding bodies backing

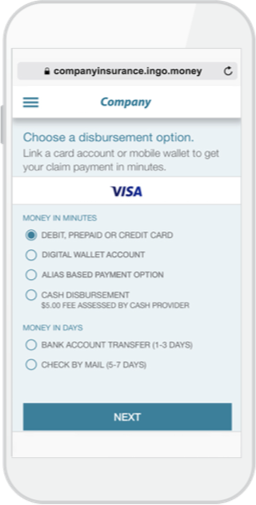

This type of finance commonly direct fund, meaning you never make an application for a government-backed home loan physically through the bodies department – your use as a consequence of an exclusive lending company that gives FHA, Virtual assistant, or USDA financing. For folks who default on the home financing that is supported by government entities, this new company pays the lender on your behalf.

Cutting risk to possess lenders

Whenever a loan provider will give you an authorities-protected mortgage, it’s including the lender gets insurance policies in your financing. Here is what lets the lending company to offer you a lot more good terms and conditions, such as for instance a lowered price or even more flexible borrowing from the bank standards.

A traditional financing isnt guaranteed because of the bodies. A personal bank, such as for example a lender otherwise credit partnership, will provide you with the mortgage instead of insurance rates on the bodies. However, really old-fashioned mortgage loans is supported by the government-backed enterprises Fannie mae or Freddie Mac computer, given it qualify established by businesses.

Each type of government-backed mortgage varies, but it is fundamentally easier to qualify for you to definitely than for a conventional home loan.

Variety of authorities-supported mortgage loans

Each type from home loan has its own requirements regarding what off percentage, credit score, and you may financial obligation-to-money proportion (DTI) you’ll want to qualify.

Understand that per lender can also be place a unique standards close fico scores and DTI ratio. Particularly, due to the fact guideline is that you can be eligible for an FHA mortgage having an effective 580 credit score, a loan provider gets the directly to say it will take an effective 600 credit history.

FHA funds

Unlike Va and you may USDA finance, FHA mortgages are not getting a specific population group. You’ll likely rating a lesser rates than you’d that have an excellent antique mortgage. This new downside is legitimate online loan you perform you prefer currency for a down commission.

- Advance payment: 3.5%

- Credit history: 580. You can get a loan that have a rating anywhere between 500 and you may 579, but you will you need a great 10% down payment.

- DTI: 43%, but you could possibly go higher which have certain compensating issues (such as for example that have a certain amount of dollars secured in order to cover your own home loan repayments if there is emergency)