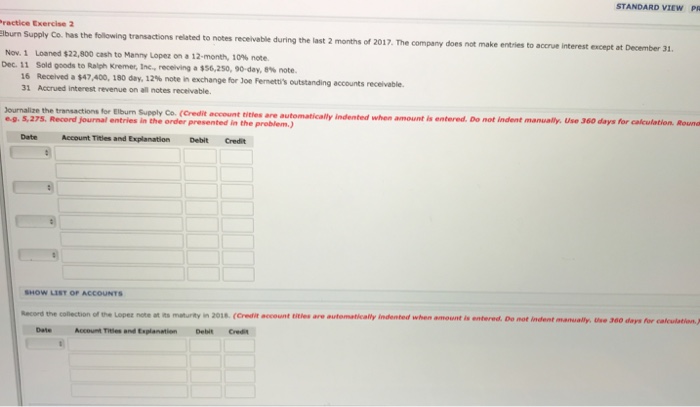

What exactly are Mortgages and exactly how Carry out It works in australia?

Modified Because of the

A home loan, or home loan since these are typically typically referred to as, allows consumers to pay for property over the years. After ten years, financial citizens pay-off the bucks it borrow with focus and you will own the property downright given that financing is actually repaid. Buying a property will be the biggest single pick or funding you make that you experienced. Therefore, before you sign to the dotted range, it pays to know the basics.

What is a home loan?

Home financing is a loan arrangement anywhere between a loan provider and you may a great visitors accustomed get a property. You (the customer) pay-off the loan inside the instalments more a-flat period of time, constantly 20 so you can 3 decades. The size of the mortgage should be reduced or stretched, depending on the count your use, certainly one of other factors.

Mortgage against. mortgage

The new words home loan and you may mortgage generally imply the same: They both identify the loan consumers take out to get a possessions. Yet not, there was actually a small difference in both terminology.

- A mortgage ‘s the money borrowed buying a property otherwise assets.

- Home financing refers to the court mortgage arrangement between the borrower together with bank.

Despite this semantic variation, you could potentially usually make use of the conditions interchangeably. In this article, we remove one another terms and conditions since exact same.

How can mortgage loans operate in Australian continent?

Mortgages are similar to other kinds of financing, particularly a car loan: Your borrow cash to cover the thing and shell out they back over the years. not, you will find book facets in order to a mortgage that will be worthy of facts.

House put

If you use home financing to acquire property, the lender (a lender otherwise standard bank) generally speaking requires an excellent 20% put towards loan – called the domestic deposit. Which put takes care of a few of the mortgage initial and you may minimizes the danger toward bank. Additionally allows you, the consumer, to cease expenses LMI (Loan providers Home loan Insurance rates). LMI is a type of insurance coverage one lenders need whether your put is below 20%. Deposits more 20% are generally perhaps not subject to LMI.

Principal and you can notice

The primary is the foot quantity of the mortgage. Including, if you purchase property having $five hundred,000 and you may shell out an effective 20% put ($100,000), $400,000 off dominant are due to the financing.

Appeal, although not, is the price of borrowing money. The lender charge appeal into the number you obtain more than a great set time period, taking into account the loan matter as well as your credit history, among other factors. Inside , the common interest for the owner-occupier mortgage brokers try 5.89% (repaired and you can variable combined), with respect to the Set aside Bank off Australian continent data.

Financial name size

Lenders may differ in length, but most include 20 in order to 30 years, with many getting 40 years.

The newest lengthened your house mortgage, the greater appeal you can payday loans in Ouray CO without bank account easily pay. For this reason, attempt to safer home financing on quickest name size your are able.

Home guarantee

Since you pay back your financial, possible begin making guarantee regarding property. This is your residence’s current worthy of without left mortgage equilibrium. Eg, if the residence is cherished at the $five-hundred,000, along with $200,000 kept in your mortgage, you’ll have more or less $300,000 in the equity. Think of, guarantee does not indicate possession – it really is the value of the home you are eligible to.

Assets ownership

If you have a home loan, that you don’t very own the property if you do not pay the mortgage when you look at the full. From the greatest setting, the financial institution pays the seller to the home, and after that you pay-off the lender.