Just how Fintech was Transforming Access to Fund for MSMEs

The sales and you may profit margins many mini, quick, and you will average-measurements of companies (MSMEs) try very vulnerable to seasonality, type in and you may work costs, late payments, pure calamities, unexpected expenses, and you may range other variables you to end up in lumpy bucks flows. Instead equity or adequate borrowing from the bank pointers, banking companies are often unwilling to provide them money, therefore this type of MSMEs deal with the additional danger of low-undertaking assets.

However, courtesy the brand new technical, the new psychology regarding financial institutions is changing in manners which can be helping MSMEs to get into finance.

Such loans are entirely different from traditional asset-supported loans, the spot where the valuation away from collaterals accessible to the lending company ount and you can tenor. New reticence regarding traditional finance companies so you can give so you can MSMEs utilizes the fact they don’t really possess fixed possessions as the collateral.

Emerging financial tech (fintech) players international is reshaping exactly how MSMEs have access to doing work investment and money move loans.

After all, money is the actual only real factor that can be pay-off a loan; guarantee is only the next solution in the event the currency can not be produced.

[tweet=”ADB’s : Income-based financing let #MSMEs supply borrowing in place of guarantee #fintech” text=”Cash flow-created fund help MSMEs supply borrowing from the bank as opposed to security”]An illustration is Kenyan seller payday loan service Build, which helps MSMEs availability resource by the factoring their cash flow time periods if you find yourself on top of that encouraging these to initiate getting off bucks so you’re able to digital repayments account through the Kopo Kopo exchange system.

A portion of one’s electronic transactions one merchants discover is set away to repay their enhances. So it plan have payments water, bite-sized, and also in line which have cash flow.

During the India, Capital Float, a non-lender monetary institution, provides instantaneous decisions to your collateral-100 % free money getting small advertisers. A threat reputation review is completed immediately because of the evaluating MSMEs’ bucks moves having fun with research of PayTM, an e-commerce percentage system and you will electronic bag organization, mobile monetary attributes company PayWorld, and you will smartphones.

Investment Float consumers perform electronic understand-your-consumer (KYC) verification, have the loan offer, show enjoy, and you can indication the borrowed funds arrangement for the a mobile app. The loan amount are paid on the account on a single go out, which have nil documentation.

Income money help MSMEs seize solutions when they occur, and so are good exemplory case of the fresh new focused, market development which enables fintech in order to compete with a lot more preferred-but reduced-traditional banks. He’s suitable to help you companies that manage extremely high margins, however, lack sufficient difficult possessions supply once the guarantee.

[tweet=”#Fintech businesses competing that have finance companies into the focused, market designs ADB’s #MSMEs” text=”Fintech enterprises contending which have finance companies toward focused, niche designs”]These types of funds generally speaking appeal to MSMEs into the retailing and you may revenue, in which controlling and you will generating top cash flow is extremely important offered the more expensive out of debt minimizing return on funding compared to the large firms.

There is an ever-increasing development of cash disperse-created financial support supported by latest and projected coming cash streams

Rural credit is even moving on on earnings-depending credit, that would lower costs and desire big banking institutions and you will creditors. Fintech solution company such as India’s CropIn Tech try delivering research, fake cleverness, and servers understanding how to banking companies to assist them ideal assess borrowing risk.

Farmer investigation toward KYC, geo-coordinates out of facilities, reputation of harvest he’s sown, crop proportions, yield and you will prospective money foundation to your spouse bank’s digital system. This post is collated that have remote-feeling studies to assume a good farmer’s efficiency, estimates of your yield, and you may price point.

The final step is actually plotting risk ratings to possess producers having fun with a great machine-studying algorithm. By the evaluating the expense of enter in/returns, confident income and you can profitability, immediate borrowing disbursal can be made inside outlying elements.

Pursuing the mortgage could have been issued, satellite photos facilitate the lending company perform secluded overseeing and you can research from the providing periodic research towards the whether or not the character has utilized the disbursed financing to your meant goal. If the pick approaches this new secure phase, the financial institution was informed in order to connect to your farmer so you’re able to start the fresh new payment techniques.

Insurance agencies trying give harvest shelter in order to smallholder producers is also together with control such technology to own underwriting and you may claims government. Throughout the whole milk industry, insurance firms is now able to funds bucks flows from the deciding the degree of settlement payable in order to a character according to each other amounts and you will quality of dairy put.

More regular costs make for the character of cash move credit and the risk rules away from fintech lenders. It involves genuine-go out income-founded underwriting and track of very leveraged equilibrium sheet sets, using newest membership and you may vendor payment investigation to your considerable amounts of small payments. The mortgage size and you may prices derive from the amount and you can stability of cash streams.

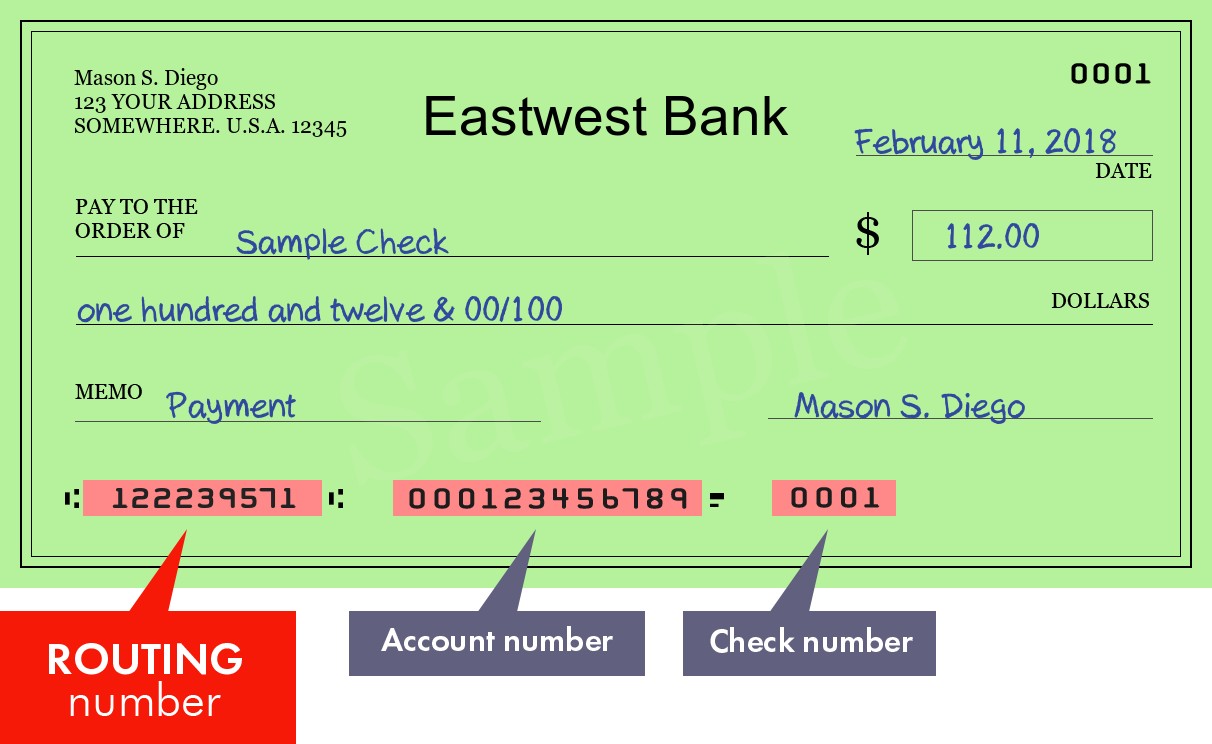

Because MSMEs typically have an individual checking account, using highly automatic cost and you may choice motors provides a clear electronic impact to own tracing a brief history of your cash circulates. Of the analyzing the internet cash flows, an exact and real-go out chance review of internet your small-name financial health from MSMEs can be produced on their repayment ability and you may exchangeability status.

That have acknowledged you to MSMEs lack the ability to build financial accounts make it possible for loan providers to evaluate their repayment potential and you will default chance, he is deploying agile and you can agile development locate an accurate knowledge of their funds transformation years

Accessibility genuine-time advice helps create exposure, as it lets the financial institution to determine the defaulting MSME quickly and band-barrier the money streams or suspend repayments prior to delinquent charges accrue. This makes zero place to possess manipulation from funds a root problem of resource-supported financing tips that are suffering diversion of money streams courtesy multiple bank accounts.

With a brand new age bracket from digital-savvy MSME citizens emerging during the developing Asia, conventional participants could possibly get soon are to try out second fiddle to fintech. The only method to endure is to try to innovate regarding the MSME money place and you may speed financing into the technology in order to future-research its networks and you may keep and you may expand its non-conventional customers.