Everything you need to understand Lowest Put Fund

Since you may or will most likely not discover, taking a low-put mortgage having less than an excellent 20% put is much more hard and costly!

But not, the isnt lost funds which have the absolute minimum 10% put are offered, though this type of can cost you so much more in fees than just pre-LVR restrictions. The fresh new generates are allowed to getting at ten% since they are exempt on the Credit rules, but you will nevertheless pay much more for having the brand new privilege out-of credit over 80%.

Make sure you remember, you’re qualified to receive a primary Home loan otherwise Earliest Home Companion and therefore only means a good 5% deposit.

Why would I-go having the lowest-put financing?

You really have protected $x hence translates to 10% off one thing. You can aquire into the possessions steps. Yes, the mortgage costs could be highest, however, zero bank will provide you with financing if you’re unable to services a loan. Provider setting you only pay from your own income and you can stated costs. Early in a discussion that have a home loan Adviser, see your face often determine what you can solution. You to investigations is computed on a high rate from the In control Financing Code within NZ. We need to ensure that you pays afterwards if costs perform increase, which means you was examined now at this higher level.

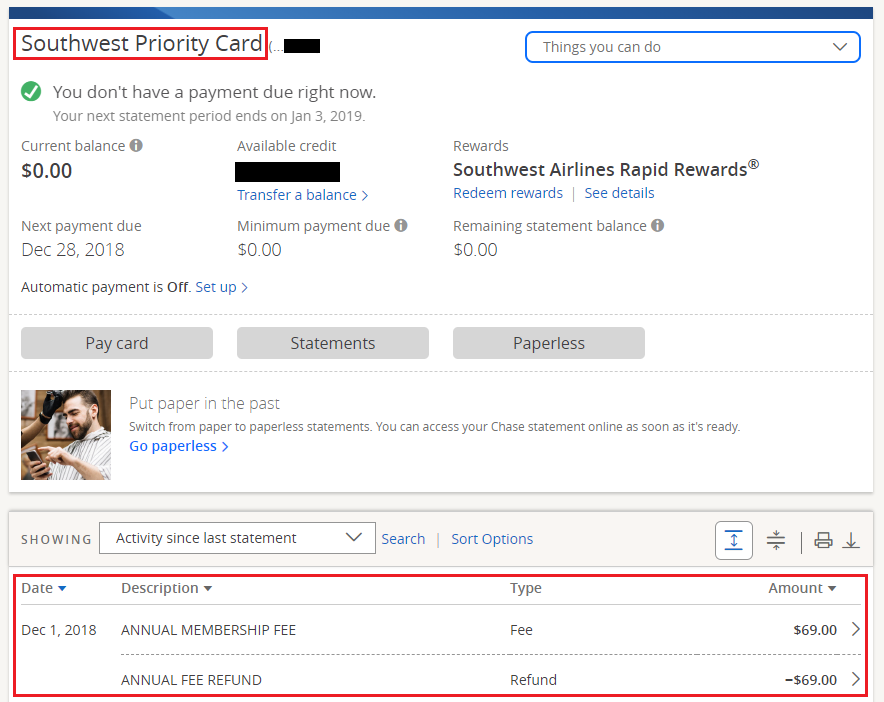

Costs having Low Deposit Financing

Due to the fact tightening up from lowest put funds, Finance companies and Loan providers haven’t merely enhanced costs and you may rates of interest, but now as well as use software charge no extended promote benefits getting legal costs.

Just what exactly charge are you currently upwards to possess?

- Reasonable Collateral Costs Lenders basically incorporate a great margin (LEM) to the interest when you’re more than 80% financing. This will are normally taken for .25% to just one.5% according to bank. Specific banking institutions together with costs the lowest equity superior (LEP) that comes when it comes to an initial paid to your how big your loan.

Legal Fees when it comes down to Pick These can cover anything from solicitor to solicitor that it is useful shop around. It certainly is good to end up being described an excellent solicitor also.

- Entered Valuation It is regular to possess banking institutions to help you consult a great valuation to possess functions are best place to get a wedding loan bought with lower than 20% deposit. Also for personal transformation. Valuations vary of $850 up according to valuer, therefore the well worth, proportions, and you may location of the property. It is purchased by Mortgage Agent when they be aware of the bank your playing with. The consumer next covers the latest valuation together with valuer goes and you may really does the valuation. The mortgage Adviser, the visitors, therefore the financial the score a copy of valuation. When your property is another type of make, up coming a beneficial valuation entitled a certification regarding End required at the the conclusion the newest generate to display it is 100% done. This can be minimal and that is a requirement on the bank to help you finish the financing.

Gaining 80% financing

It is all about precisely how your build the loan should you get your residence. Start off by working they right down to 85% borrowing from the bank, then extra rate of interest decrease. Following have it right down to 80% and then you try where you therefore the lender want to be within 80% lending.

Thus, in terms of getting that loan which have a decreased deposit it does pay to buy to, not just to come across a loan provider who even offers lowest put money, but also to find the best price.

What exactly is actually Lower Collateral Costs and you can Margins everything about?

Due to the high-risk to possess banking institutions regarding reduced deposit financing, he’s necessary to take out a creditors mortgage insurance policies to help you reduce the exposure. The reduced collateral payment talks about the expense of so it insurance coverage.

Strategies for Getting to Yes’ on bank having finance which have lower than 20% deposit

While it’s fair to say that it is difficult regarding current climate to locate a loan that have less than 20% put thru a bank, you might still have the ability to get you to definitely when you have a very strong software. To possess a combat options, individuals will likely need satisfy the after the standards;

- Features advanced level credit score

- Essentially a protected deposit

- Have demostrated a economic government and just have excellent account run (zero unauthorised overdrafts, dishonours)

- An excellent excess regarding finance once the costs subtracted

- Very few personal debt

- Regular long-term work/money