Advantages and disadvantages away from Domestic Security Money

Home Guarantee Financing Certification Criteria

Household security loans render people the opportunity to make use of new equity obtained produced in their residence, in the course of time so that you can actually fool around with its financing. These types of funds render economic liberty, whether or not for renovations, consolidating financial obligation, otherwise financial support existence events. But loans Sandy Hook not, as with any mortgage software, consumers have to satisfy particular standards in order to safer such finance.

- Enough home collateral: Only a few equity is actually tappable security. Very loan providers require that you maintain at the very least 10-20% equity yourself following the financing, that offers a support in case home values drop-off. Put simply, thus you can’t borrow a full quantity of collateral accumulated. Alternatively, you can merely obtain up to 80-90% of it.

- Credit score: Your own creditworthiness takes on an enormous role into the deciding the loan terminology and you will interest rate. Good credit, typically as much as 680 otherwise above, shows a reputation in charge borrowing administration and timely repayments, giving loan providers so much more depend on in your capability to pay the mortgage. Griffin Resource encourage a credit score as little as 660, however, keep in mind that a high credit score commonly head to higher prices and terms.

- Debt-to-income (DTI) ratio: The DTI ratio was an excellent metric loan providers use to evaluate if or not you can afford a different sort of loan. It tips their monthly financial obligation money up against your own disgusting month-to-month income. Lenders typically get a hold of good DTI below 43%, since it ways a far greater balance ranging from income and you will debt. Yet not, Griffin Money will accept good DTI all the way to 50%.

- Loan-to-worthy of (LTV) ratio: LTV is comparable to the new collateral you really have of your property which will be calculated of the separating the amount your debt on the home loan from the property’s appraised worth. Including, for many who are obligated to pay $150,000 as well as your home is appraised at the $200,000, this new LTV is actually 75%. Lenders has a preferred LTV threshold and usually like an LTV away from 80% otherwise down.

- Stable work and money: Uniform income assurances you can meet with the month-to-month cost debt of a house security mortgage. Loan providers often typically consult spend stubs, W-2s, and you will tax statements to verify the a job position and you can money membership. People who find themselves thinking-operating or keeps adjustable money you’ll face so much more scrutiny and need to provide extra documents. But not, they could plus sign up for a zero doctor home equity loan enabling these to meet the requirements having fun with alternative documentation. For instance, they could fool around with a bank statement domestic guarantee loan that enables them to meet the requirements using several otherwise 24 months’ property value bank comments rather than spend stubs otherwise W-2s.

- Possessions sorts of and you will standing: The kind of assets and its condition may influence a great lender’s decision. A primary home possess additional guarantee standards versus a good leasing assets or travel family, according to lender. Concurrently, lenders should ensure their financial support are voice. Home that require extreme fixes otherwise have portion prone to disasters may have stricter financing terminology or perhaps ineligible to own specific HELOANs.

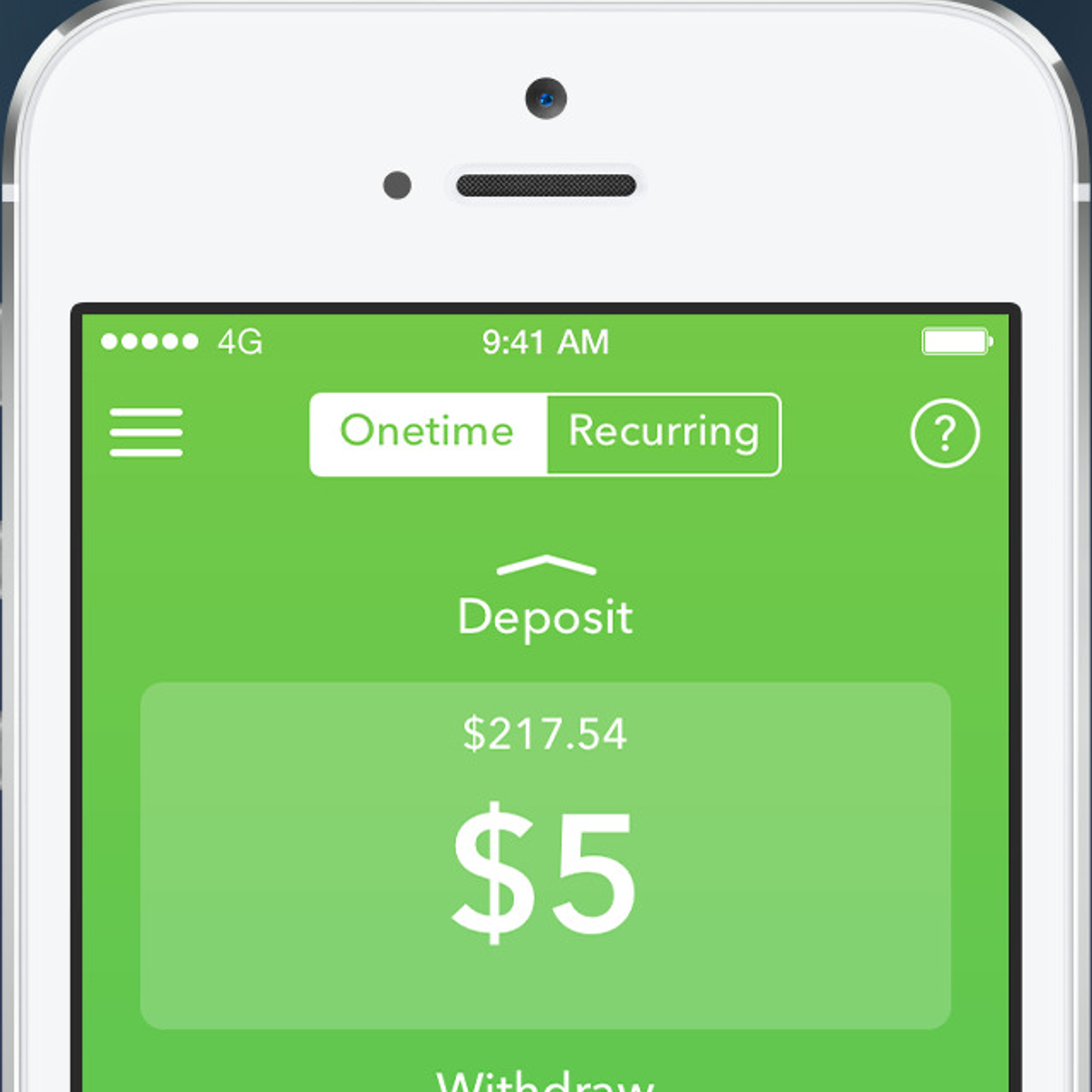

Install the latest Griffin Gold app today!

Home collateral financing will likely be an approach to of numerous financial needs, regarding extreme expenses such as training to help you debt consolidating. not, as with any monetary gadgets, HELOANs come with her number of advantages and disadvantages.

Benefits associated with domestic equity money

The most significant advantageous asset of a house equity mortgage is that it allows that influence the fresh equity you’ve made in your own household if you are paying off their principal equilibrium. Most other advantages of these types of fund through the pursuing the:

- Repaired interest rates: One of the first benefits of home collateral funds would be the fact many of them have repaired rates. In lieu of varying rates which can be determined by field activity and you will can result in erratic monthly premiums, fixed interest levels are still intact across the loan’s term. That it predictability could offer balance and you can visibility. Knowing the direct matter you are able to shell out every month can also be increase budgeting and you may economic considered, deleting the newest problems of potential rate nature hikes.