Uncovering Defects inside FHA Appraisal & Financing Review Procedure

The story with the solitary mom’s harrowing expertise in a flawed home buy and you can HUD’s negligent supervision exposes deep flaws on the FHA assessment and you can mortgage review procedure. When you look at the domestic evaluation, several circumstances had been flagged. The vendor, an investor who had purchased the house in an estate business, are unaware of the septic bodies location. The seller provided to feel the tanks pumped therefore the venue might possibly be calculated. By the time this new AMC appraiser turned up, the brand new septic tank was found and you can kept uncovered to your appraiser to observe. Regardless of this, new AMC appraiser noted the house due to the fact which have social water and you can sewer, failing to note the new FHA’s minimal property criteria toward point within well and you may septic. This new assessment was accepted, while the family finalized.

She invested the previous 2 yrs compromising and reconstructing their particular credit their unique ex-husband missing, to earn the legal right to be a resident

90 days afterwards, the fresh new debtor began feeling plumbing products and you can read the better and septic program would have to be totally replaced at a high price surpassing $100,000 above and beyond their unique setting. Within the evaluating FHA guidance, she found the brand new blazing abuses which will were trapped. Whenever she stated the mistake for the financial, she was informed the assessment was just meant to influence worthy of, perhaps not guarantee the household came across FHA minimum assets criteria. HUD echoed that it, position the responsibility to your borrower’s domestic assessment. Trapped from inside the a headache condition, the latest debtor filed suit from the bank and you can appraiser.

Exactly what used was a pulled-away court competition filled with obfuscation and deceit. The lending company tried to claim new borrower got bought the home as is, ignoring the newest FHA’s specific criteria. HUD, whenever called, refused to intervene, stating there’s absolutely nothing they could carry out. It had been only from the borrower’s dogged effort one she uncovered a frustrating development HUD lets loan providers to notice-statement mortgage defects and you may categorize them in manners you to definitely stop penalties, even when the circumstances is actually significant adequate to generate property unlivable. In such a case, the lending company categorized the new defect as the a tier 4, definition they failed to see and may even n’t have recognized towards things, even with facts quite the opposite.

Even worse still, HUD acknowledged the financial institution needed to acquisition an industry comment when a debtor complains, however, told the lender they did not have to take action in cases like this. The new appraiser, at the same time, is actually found having intentionally omitted key information throughout the assessment, cropping aside a deck and you will wall, and you may failing continually to notice several other problems that should provides called for the home is appraised susceptible to repairs. But really when the debtor needed so you’re able to depose the fresh new appraiser, brand new request is dismissed because the laughable.

Ultimately, the brand new process of law sided to the lender and you will appraiser, making the newest debtor along with her youngsters abandoned and you can economically devastated. HUD’s a reaction to issues indicated that this new problem categorization are improper as well as the bank should have come required to mitigate the challenge, nevertheless the company has done nothing to fix the trouble. It unmarried mother’s persistent endeavor features applied exposed HUD’s incapacity to help you properly manage new FHA assessment and you can financing opinion procedure. Their own story was a good damning indictment regarding a system which allows predatory strategies to survive at the expense of people it is designed to serve.

Shedding the fight to help you Winnings the battle: Exactly how a single mom out of two’s refusal to cease exposed HUD’s defected problem taxonomy

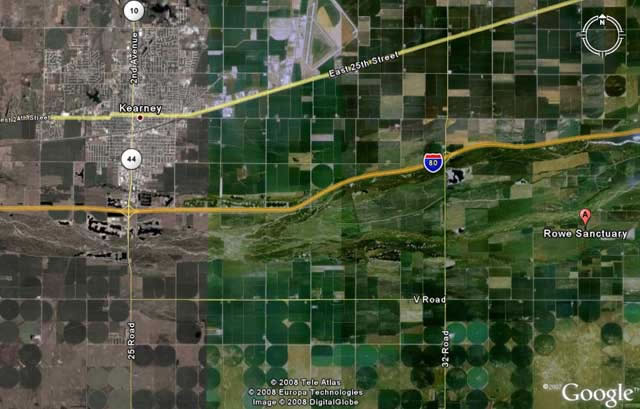

Just after sacrificing for many years in order to rebuild her borrowing from the bank and secure new directly to end up being a https://paydayloansconnecticut.com/south-wilton/ citizen, which borrower found their particular fantasy house in the united kingdom or so she thought

From inside the recently divorced debtor and you may solitary mother away from several discover good quaint family in the country, 60 miles from their earlier, to start more along with her college students. She submitted a keen FHA promote and you will planned her very own domestic assessment. Because so many home inspections carry out, this new inspector flagged multiple products which she additional in a revised conversion offer into the supplier to own fixed. The fresh new number said the house or property was better and you may septic, nevertheless the seller, who was simply an investor, ordered the house given that a property product sales thus did not understand its place, nor was just about it to the questionnaire. She expected to obtain the tanks pumped with the intention that the fresh merchant discover they. It absolutely was discover days after their domestic review and you will remaining uncovered on house’s top flower sleep below 10ft on residence’s front door before appraisal for the appraiser to observe.