Times Interest Earned Ratio Analysis Formula Example

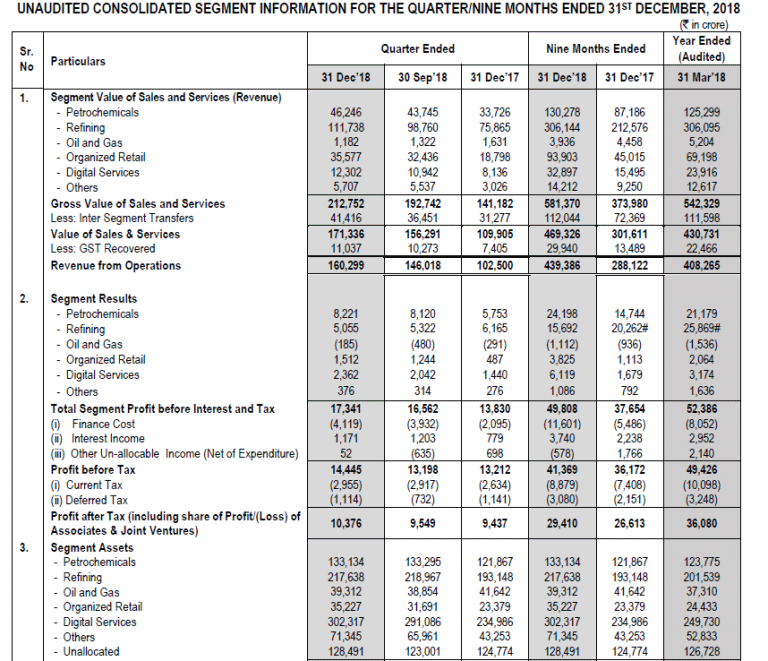

Since these interest payments are usually made on a long-term basis, they are often treated as an ongoing, fixed expense. As with most fixed expenses, if the company can’t make the payments, it could go bankrupt and cease to exist. The times interest earned (TIE) ratio is a financial metric that measures a company’s ability to fulfill its interest obligations on outstanding debt. It is calculated by dividing a company’s earnings before interest and taxes (EBIT) by its interest expense within a specific period, typically a year. If a business takes on additional debt after an increase in interest rates, the total annual interest expense will be higher. If operating expenses increase, current earnings may decline, and the firm’s creditworthiness may be affected.

What Does a High Times Interest Earned Ratio Signify for a Company’s Future?

It is commonly used to determine whether a prospective borrower can afford to take on any additional debt. As economic downturns have a significant impact on all accounting operations of a business, it also possesses the ability to turn a good TIE ratio into a low TIE ratio, which hinders business growth. This means that you will not find your business able to satisfy moneylenders and secure your dividends. More expenditure means asset to equity ratio less TIE, and ultimately means that you need loan extensions or a mortgage facility if you want to keep on surviving in the business world. Downturns like these also make it hard for companies to convert their sales into cash, hindering their ability to meet debt obligations even with a good TIE ratio. The debt service coverage ratio determines if a company can pay all interest and principal payments (also called debt service).

How to Calculate TIE

- A higher ratio is favorable as it indicates the Company is earning higher than it owes and will be able to service its obligations.

- Rho’s platform is an ideal solution for managing all expenses and payments.

- Said differently, the company’s income is four times higher than its yearly interest expense.

- A multi-step income statement provides more detail than a traditional income statement, and includes EBIT.

- It is a measure of a company’s ability to meet its debt obligations based on its current income.

The company’s shareholders expect an annual dividend payment of 8% plus growth in the stock price of XYZ. Compound interest is like the secret power of a superhero because it gives you powerful growth of your savings over time. Compound interest is when you earn interest every year not only on the original amount you deposit into an account, but you also earn interest on interest! Let’s look at an example to see how compound interest and different interest rates, the percentage at which money grows over a specified period, impact the growth of your money over time. As a general rule of thumb, the higher the times interest earned ratio (TIE), the better off the company is from a credit risk standpoint.

What a High Times Interest Earned Ratio Can Tell You

TIE is calculated as EBIT (earnings before interest and taxes) divided by total interest expense. The higher the times interest earned ratio, the more likely the company can pay interest on its debts. The times interest earned (TIE) ratio is a solvency ratio that determines how well a company can pay the interest on its business debts. It is a measure of a company’s ability to meet its debt obligations based on its current income. The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt.

Times interest earned ratio formula

A higher ratio is favorable as it indicates the Company is earning higher than it owes and will be able to service its obligations. In contrast, a lower ratio indicates the company may not be able to fulfill its obligation. Thus, it shows how many times of the earnings made by the business will be enough to cover the debt repayment and make the company financially stable and sustainable. The times interest earned ratio shows how many times a company can pay off its debt charges with its earnings.

Calculating business times interest earned

A good TIE ratio is subjective and can vary widely depending on the industry, economic conditions, and the specific circumstances of a company. However, as a general rule of thumb, a TIE ratio of 1.5 to 2 is often considered the minimum acceptable margin for assuring creditors that the company can fulfill its interest obligations. Solvency ratios determine a firm’s ability to meet all long-term obligations, including debt payments. If a company raises capital using debt, management must determine if the business can generate sufficient earnings to make all interest payments on debt. However, this is not the only criteria that is used to judge the creditworthiness off an entity. It should be used in combination with other internal and external factors that influence the business.

As a point of reference, most lending institutions consider a time interest earned ratio of 1.5 as the minimum for any new borrowing. The significance of the interest coverage ratio value will be determined by the amount of risk you’re comfortable with as an investor. Learn more about how to prep yourself for an SBA loan that can help grow your business and have cash reserves so that you can build better product experiences.

It specifically compares the income a company makes before interest and taxes against what interest expense it must pay on its debt obligations. The times interest earned ratio doesn’t include principal payments, either. A company might have more than enough revenue to cover interest payments but it may face principal obligations coming due that it won’t be able to pay. A higher times interest earned ratio is favorable because it means that the company presents less of a risk to investors and creditors in terms of solvency. An organization that has a times interest earned ratio greater than 2.5 is considered an acceptable risk.

This is a detailed guide on how to calculate Times Interest Earned (TIE) ratio with thorough interpretation, example, and analysis. You will learn how to use its formula to determine a business debt repayment capacity. To have a detailed view of your company’s total interest expense, here are other metrics to consider apart from times interest earned ratio. Dill’s founders are still paying off the startup loan they took at opening, which was $1,000,000. Last year they went to a second bank, seeking a loan for a billboard campaign. The founders each have “company credit cards” they use to furnish their houses and take vacations.

The times interest earned ratio (TIE) is calculated as 2.15 when dividing EBIT of $515,000 by annual interest expense of $240,000. To assess a company’s ability to pay principal plus interest on debt, you can also use the debt service coverage ratio. The debt service coverage ratio (DSCR) is net operating income divided by debt service, which includes principal and interest. In some respects the times interest ratio is considered a solvency ratio because it measures a firm’s ability to make interest and debt service payments.